Exhibit 99.2

Pacific Ethanol, Inc. Specialty Alcohols and Essential Ingredients INVESTOR PRESENTATION Fall 2020

Disclaimer 2 Statements and information contained in this communication that refer to or include Pacific Ethanol’s estimated or anticipated future results or other non - historical expressions of fact are forward - looking statements that reflect Pacific Ethanol’s current perspective of existing trends and information as of the date of the communication . Forward looking statements generally will be accompanied by words such as “anticipate,” “believe,” “plan,” “could,” “should,” “estimate,” “expect,” “forecast,” “outlook,” “guidance,” “intend,” “may,” “might,” “will,” “possible,” “potential,” “predict,” “project,” or other similar words, phrases or expressions . Such forward - looking statements include, but are not limited to, statements concerning future market conditions, Pacific Ethanol’s new business focus and its effects ; Pacific Ethanol’s ability to obtain additional regulatory qualifications and their effects ; Pacific Ethanol’s intentions to sell or repurpose its Western assets ; Pacific Ethanol’s expectations of generating net sales, net income and Adjusted EBITDA in the stated amounts for the third quarter ; and Pacific Ethanol’s other plans, objectives, expectations and intentions . It is important to note that Pacific Ethanol’s plans, objectives, expectations and intentions are not predictions of actual performance . Actual results may differ materially from Pacific Ethanol’s current expectations depending upon a number of factors affecting Pacific Ethanol’s business . These factors include, among others, adverse economic and market conditions, including for specialty alcohols and essential ingredients ; export conditions and international demand for Pacific Ethanol’s products ; fluctuations in the price of and demand for oil and gasoline ; raw material costs, including production input costs, such as corn and natural gas ; the continuing effects – both positive and negative – of the novel coronavirus ; and the ability of Pacific Ethanol to timely and successfully execute on its strategic realignment and new business focus . These factors also include, among others, the inherent uncertainty associated with financial and other projections ; the anticipated size of the markets and continued demand for Pacific Ethanol’s products ; the impact of competitive products and pricing ; the risks and uncertainties normally incident to the specialty alcohol production and marketing industries ; changes in generally accepted accounting principles ; successful compliance with governmental regulations applicable to Pacific Ethanol’s distilleries, products and/or businesses ; changes in laws, regulations and governmental policies, including the outcome of litigation concerning small refinery exemptions ; the loss of key senior management or staff ; and other events, factors and risks previously and from time to time disclosed in Pacific Ethanol’s filings with the Securities and Exchange Commission including, specifically, those factors set forth in the “Risk Factors” section contained in Pacific Ethanol’s Quarterly Report on Form 10 - Q filed with the Securities and Exchange Commission on August 13 , 2020 .

Management Presenters 3 Mike Kandris President and Chief Executive Officer • Named CEO in May 2020 • Director since June 2008 and COO from January 2013 to May 2020 • Previously served as an independent contractor to the Company with focus on plant operations • 30 Years of general management experience in the transportation and logistics industry, including as President and COO of Ruan Transportation Management Systems • B.S. in Business from California State University, Hayward Bryon McGregor Chief Financial Officer • 30 Years of treasury and finance experience • Prior to joining Pacific Ethanol in 2008 as CFO, served as Brokerage Treasurer for E*TRADE Financial with responsibility for U.S. and international brokerage treasury operations, corporate finance and investor relations • Prior to E*TRADE, project finance head for BP (formerly ARCO) and prior to that a Director at Credit Suisse • B.S. degree in Business Management from Brigham Young University

Table of Contents 1. Company Overview 2. Industry & Markets 3. Strategy 4. Financial Overview 4

1. Company Overview 5

Who We Are • Major producer of specialty alcohols and essential ingredients • 180 Acre campus in Pekin, IL • 250 mmgy of alcohol production capacity • Focused on four key markets • Health, Home & Beauty • Food & Beverage • Essential Ingredients • Renewable Fuels • Unique capabilities to produce specialty alcohols – ~50% of production from GNS, USP, API and Industrial grades • Customers include major food & beverage and consumer products companies • Publicly traded with ~$690 million market capitalization (1) 6 (1) Based on $10.83 share price and 63.5mm shares outstanding as of October 19, 2020

What We Do – Alcohols 7 GNS / Food & Beverage API Grade Alcohol Industrial Grade Alcohol USP Grade Alcohol Ethanol (Renewable Fuel) Note: API certification will be attained by year - end 2020 We transform corn into specialty alcohols used in a wide range of consumer and commercial products Illustrative End - Use Products

What We Do – Essential Ingredients 8 Aventine TM Yeast Corn Gluten We transform corn into high value essential ingredients used in a wide range of consumer and commercial products Distillers Grains Corn Oil and Corn Germ Illustrative End - Use Products

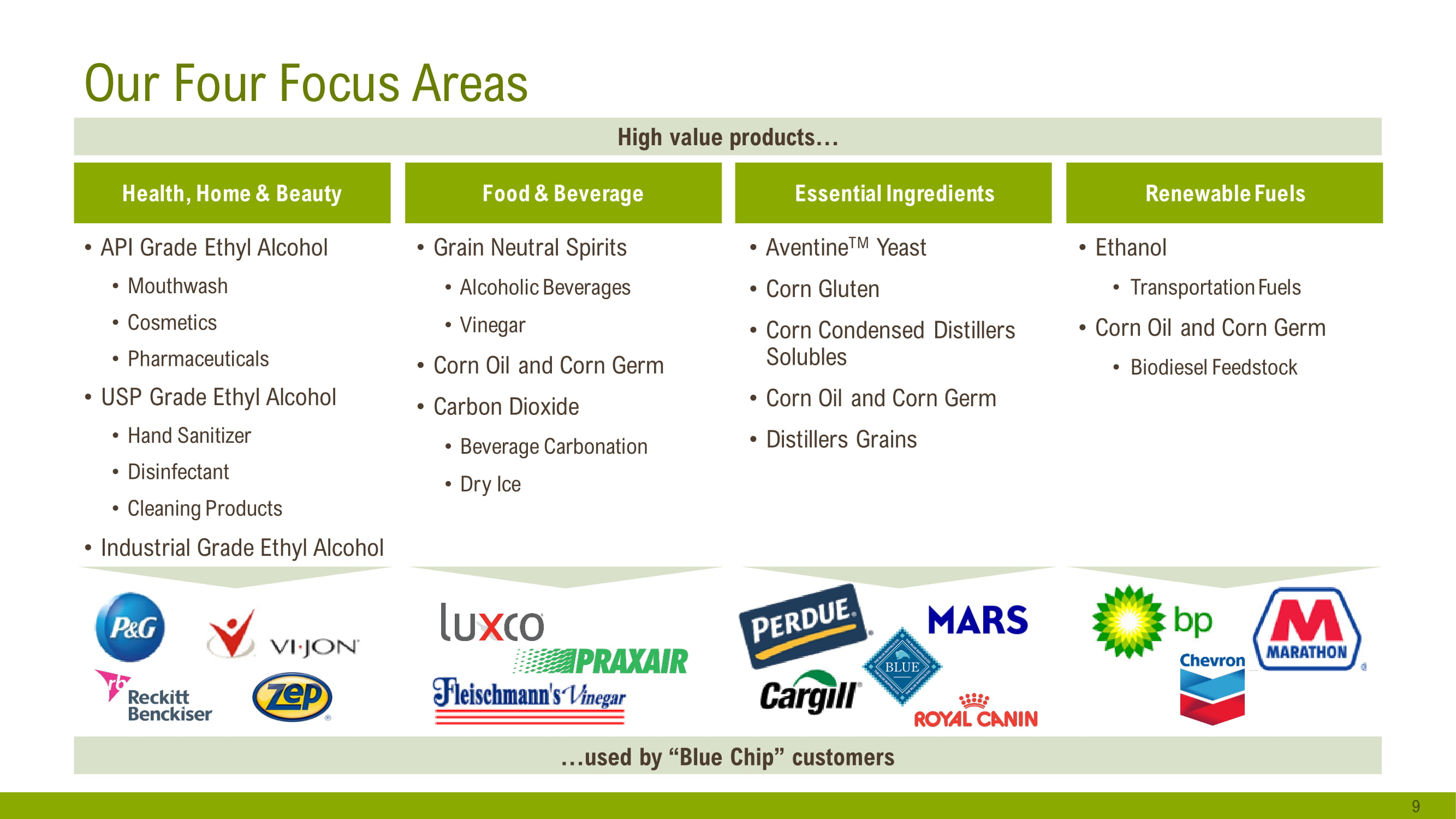

Our Four Focus Areas • API Grade Ethyl Alcohol • Mouthwash • Cosmetics • Pharmaceuticals • USP Grade Ethyl Alcohol • Hand Sanitizer • Disinfectant • Cleaning Products • Industrial Grade Ethyl Alcohol 9 Health, Home & Beauty Food & Beverage Essential Ingredients Renewable Fuels • Grain Neutral Spirits • Alcoholic Beverages • Vinegar • Corn Oil and Corn Germ • Carbon Dioxide • Beverage Carbonation • Dry Ice • Aventine TM Yeast • Corn Gluten • Corn Condensed Distillers Solubles • Corn Oil and Corn Germ • Distillers Grains • Ethanol • Transportation Fuels • Corn Oil and Corn Germ • Biodiesel Feedstock High value products… …used by “Blue Chip” customers

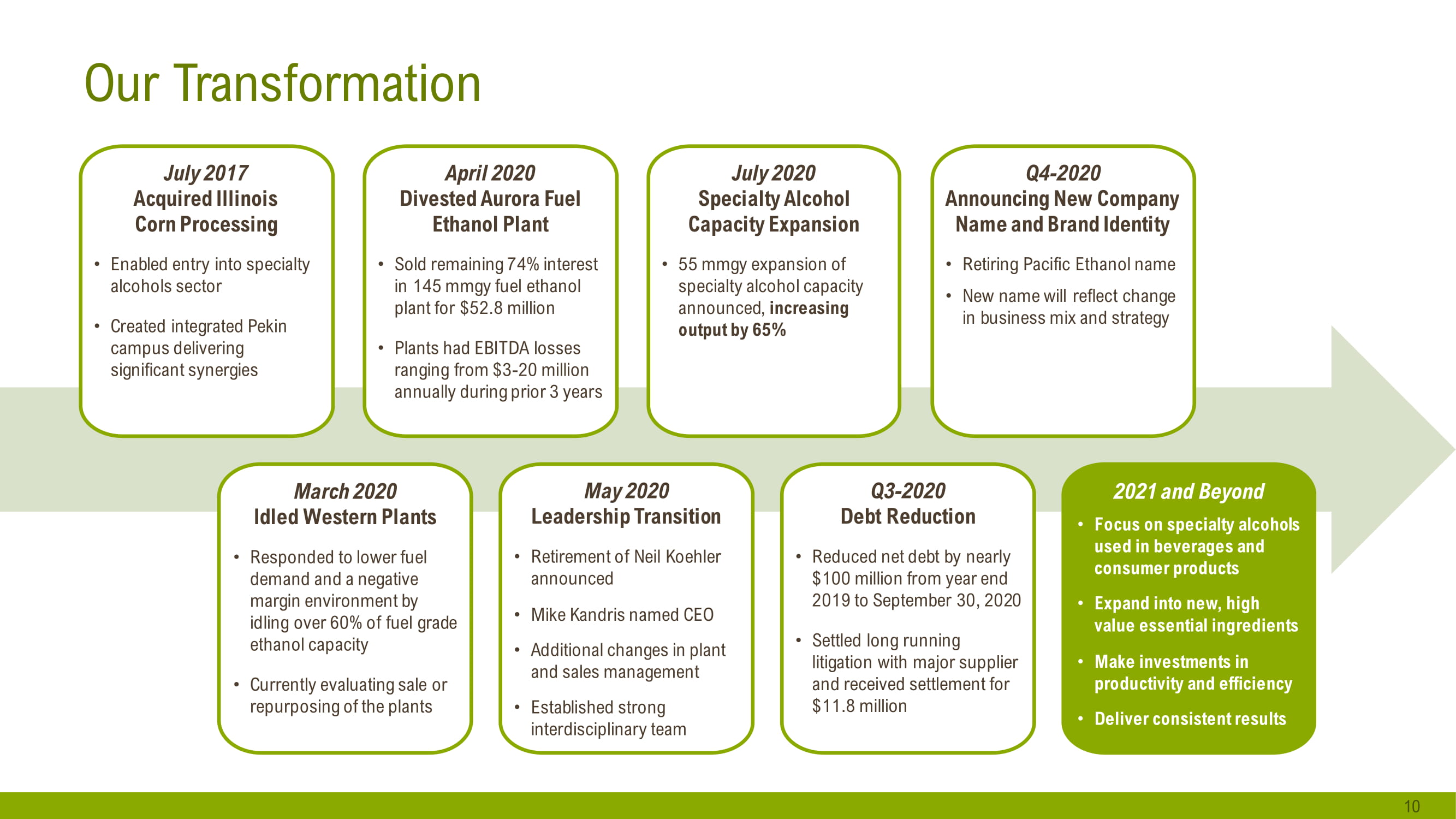

Our Transformation 10 July 2017 Acquired Illinois Corn Processing • Enabled entry into specialty alcohols sector • Created integrated Pekin campus delivering significant synergies April 2020 Divested Aurora Fuel Ethanol Plant • Sold remaining 74% interest in 145 mmgy fuel ethanol plant for $52.8 million • Plants had EBITDA losses ranging from $3 - 20 million annually during prior 3 years July 2020 Specialty Alcohol Capacity Expansion • 55 mmgy expansion of specialty alcohol capacity announced, increasing output by 65% Q4 - 2020 Announcing New Company Name and Brand Identity • Retiring Pacific Ethanol name • New name will reflect change in business mix and strategy Q3 - 2020 Debt Reduction • Reduced net debt by nearly $100 million from year end 2019 to September 30, 2020 • Settled long running litigation with major supplier and received settlement for $11.8 million May 2020 Leadership Transition • Retirement of Neil Koehler announced • Mike Kandris named CEO • Additional changes in plant and sales management • Established strong interdisciplinary team March 2020 Idled Western Plants • Responded to lower fuel demand and a negative margin environment by idling over 60% of fuel grade ethanol capacity • Currently evaluating sale or repurposing of the plants 2021 and Beyond • Focus on specialty alcohols used in beverages and consumer products • Expand into new, high value essential ingredients • Make investments in productivity and efficiency • Deliver consistent results

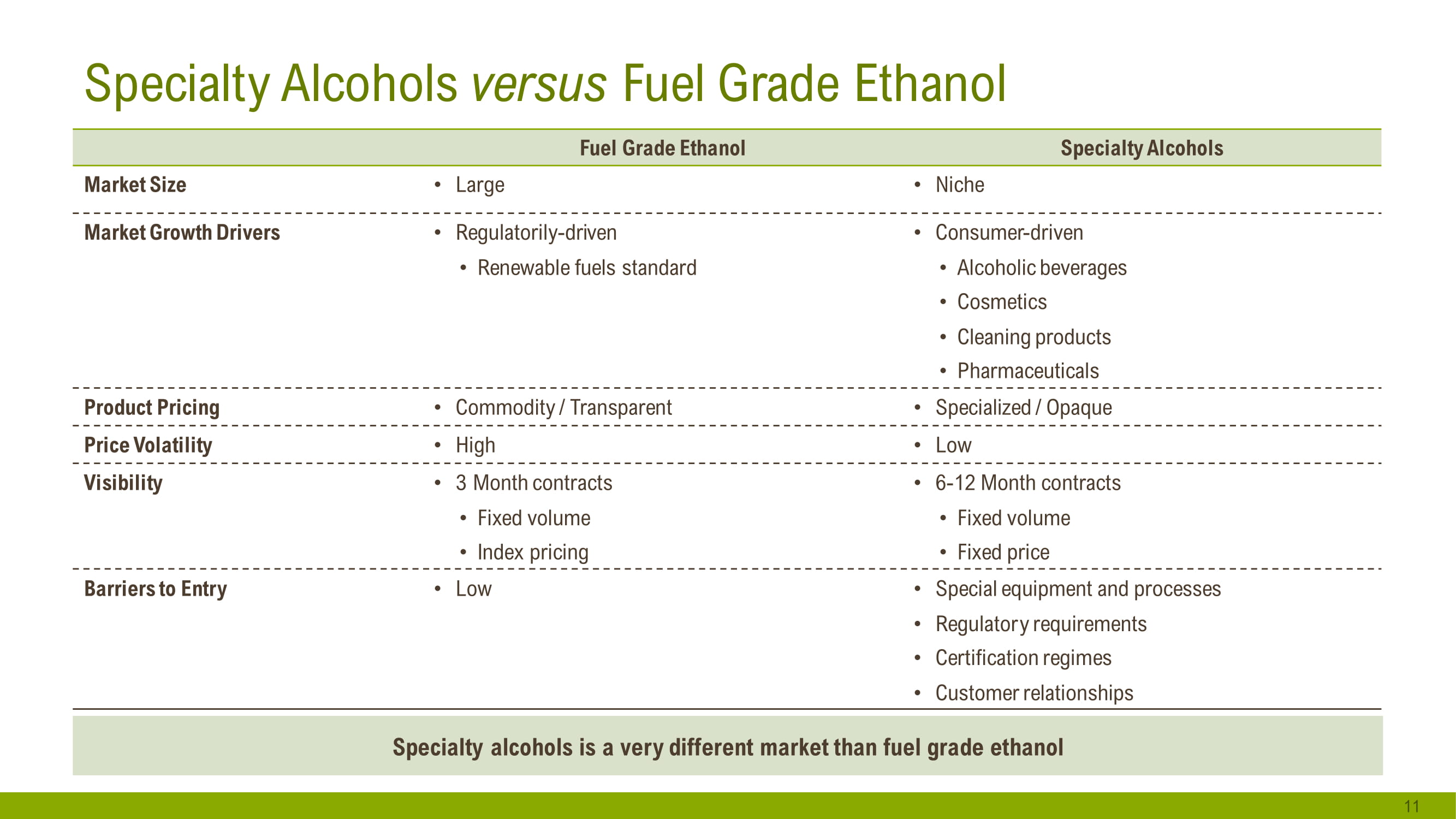

Specialty Alcohols versus Fuel Grade Ethanol 11 Fuel Grade Ethanol Specialty Alcohols Market Size • Large • Niche Market Growth Drivers • Regulatorily - driven • Renewable fuels standard • Consumer - driven • Alcoholic beverages • Cosmetics • Cleaning products • Pharmaceuticals Product Pricing • Commodity / Transparent • Specialized / Opaque Price Volatility • High • Low Visibility • 3 Month contracts • Fixed volume • Index pricing • 6 - 12 Month contracts • Fixed volume • Fixed price Barriers to Entry • Low • Special equipment and processes • Regulatory requirements • Certification regimes • Customer relationships Specialty alcohols is a very different market than fuel grade ethanol

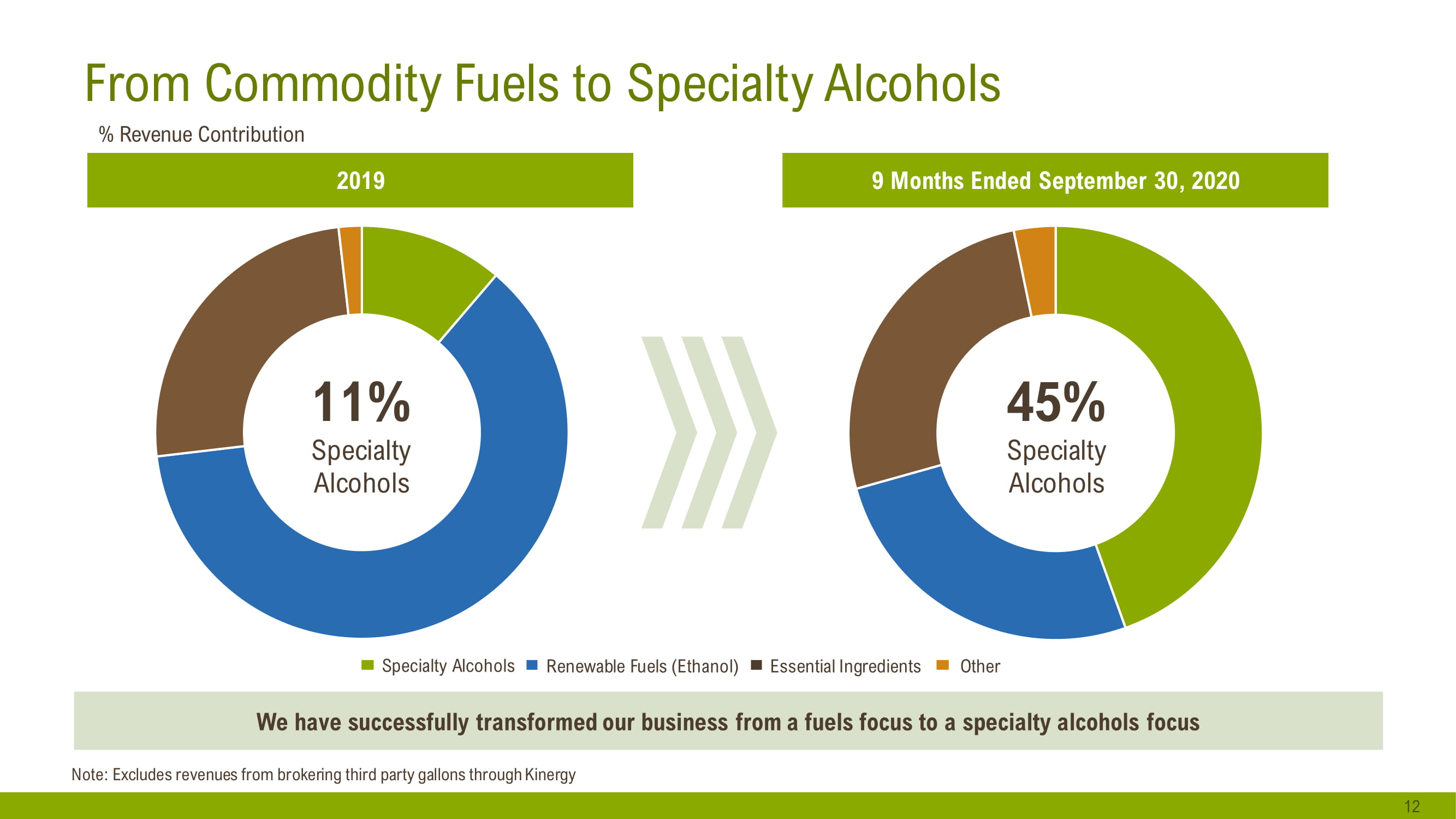

From Commodity Fuels to Specialty Alcohols 12 2019 9 Months Ended September 30, 2020 We have successfully transformed our business from a fuels focus to a specialty alcohols focus % Revenue Contribution Note: Excludes revenues from brokering third party gallons through Kinergy 11% Specialty Alcohols 45% Specialty Alcohols Specialty Alcohols Renewable Fuels (Ethanol) Essential Ingredients Other

What Makes Us Unique • Established producer of alcohol used in hand sanitizer with longstanding reputation for safe products • Strong demand for hand sanitizers and disinfecting cleaners for the foreseeable future • Increasing regulation of hand sanitizers favors incumbent producers 13 Strategic Location Good Visibility Beneficiary of COVID • Location in the corn belt provides access to abundant, low cost corn feedstock • Ability to ship by truck, barge or rail • Direct access to the Mississippi River system – creates economical access to international markets • Connected to all major Class I railroads • 12 months of visibility on specialty alcohol demand • Historically 80% of next year’s specialty alcohol revenues contracted during Q4 of the prior year • Majority of 2021 specialty alcohol production already contracted at fixed prices Focus on Specialty Alcohols • ~50% of production is specialty alcohols • High margin products with low price volatility • Significant barriers to entry – regulation, certifications and customer relationships

2. Industry & Markets 14

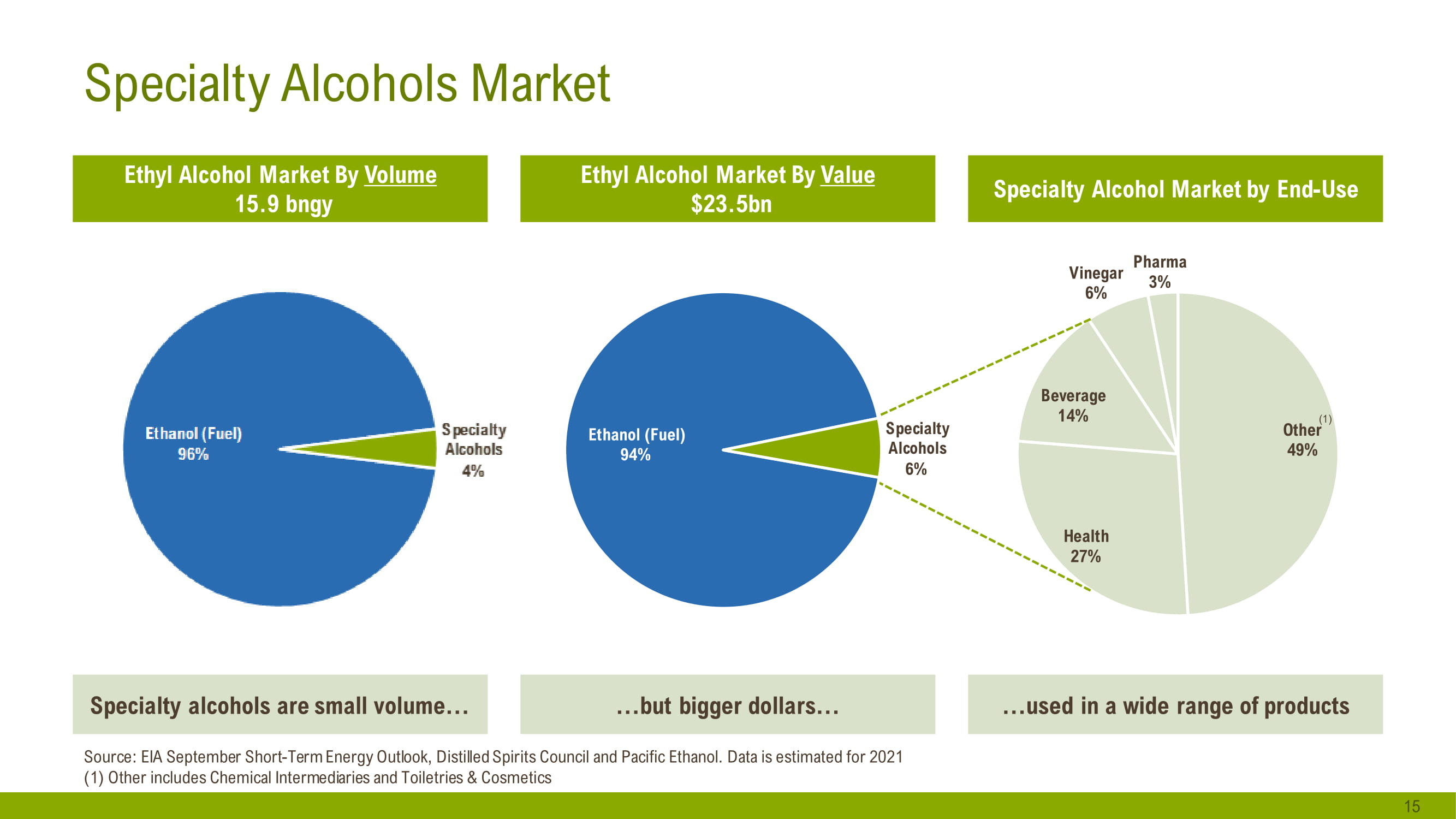

Other 49% Health 27% Beverage 14% Vinegar 6% Pharma 3% Ethanol (Fuel) 94% Specialty Alcohols 6% Specialty Alcohols Market 15 Ethyl Alcohol Market By Volume 15.9 bngy Ethyl Alcohol Market By Value $23.5bn Specialty alcohols are small volume… Source: EIA September Short - Term Energy Outlook, Distilled Spirits Council and Pacific Ethanol. Data is estimated for 2021 (1) Other includes Chemical Intermediaries and Toiletries & Cosmetics Specialty Alcohol Market by End - Use …but bigger dollars… …used in a wide range of products (1)

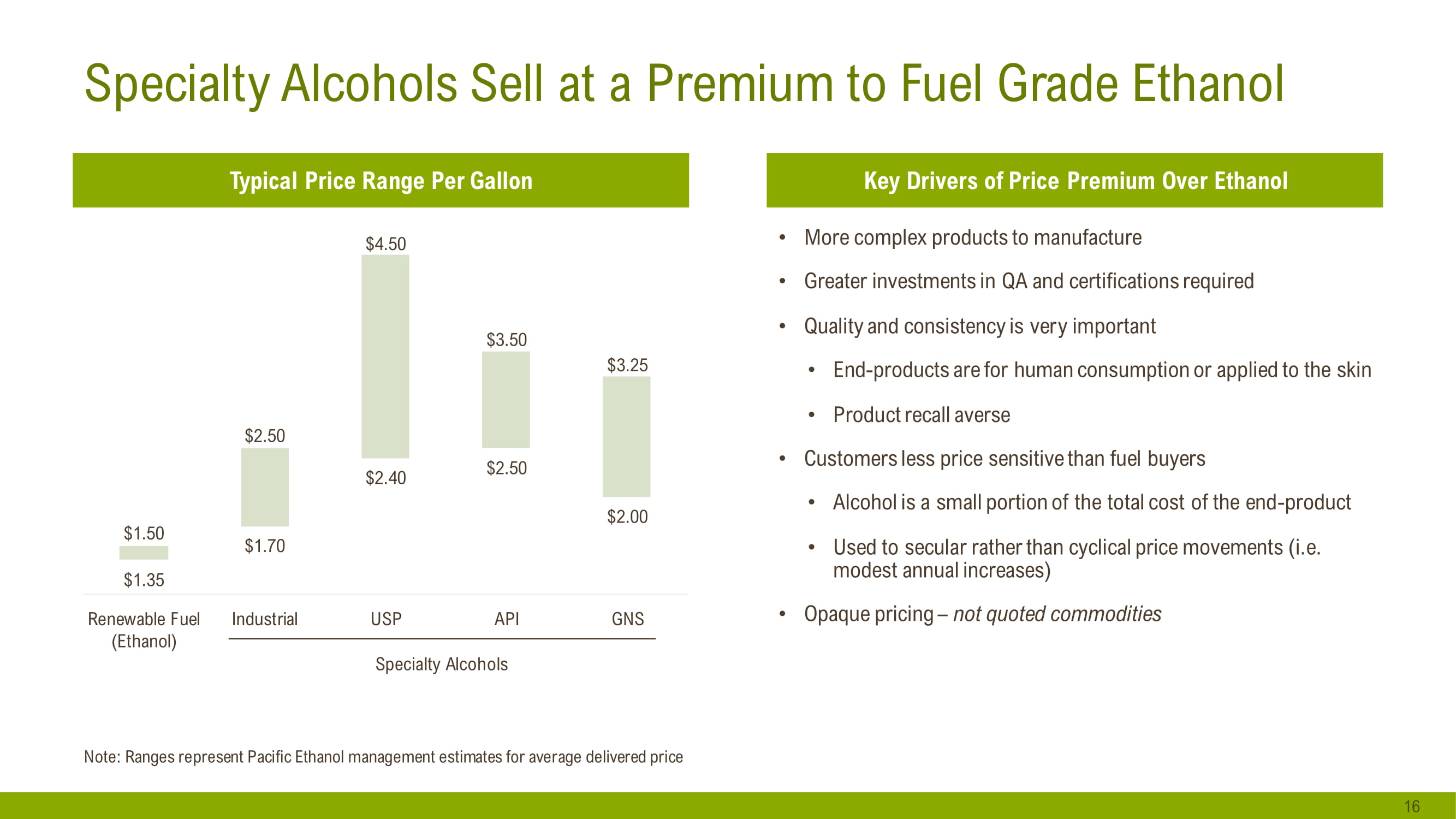

Specialty Alcohols Sell at a Premium to Fuel Grade Ethanol 16 Key Drivers of Price Premium Over Ethanol • More complex products to manufacture • Greater investments in QA and certifications required • Quality and consistency is very important • End - products are for human consumption or applied to the skin • Product recall averse • Customers less price sensitive than fuel buyers • Alcohol is a small portion of the total cost of the end - product • Used to secular rather than cyclical price movements (i.e. modest annual increases) • Opaque pricing – not quoted commodities $1.35 $1.70 $2.40 $2.50 $2.00 $1.50 $2.50 $4.50 $3.50 $3.25 Renewable Fuel (Ethanol) Industrial USP API GNS Typical Price Range Per Gallon Specialty Alcohols Note: Ranges represent Pacific Ethanol management estimates for average delivered price

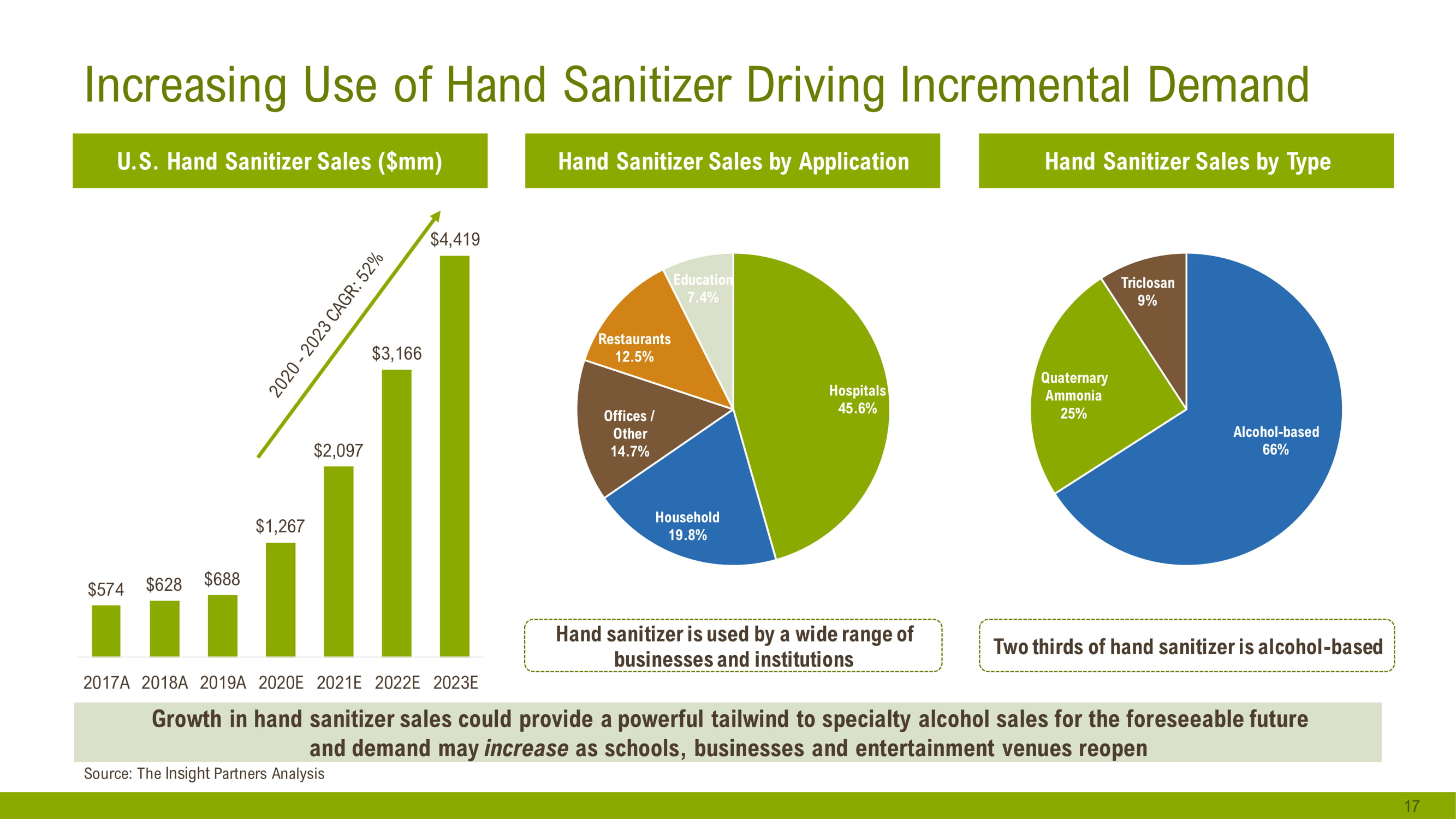

$574 $628 $688 $1,267 $2,097 $3,166 $4,419 2017A 2018A 2019A 2020E 2021E 2022E 2023E U.S. Hand Sanitizer Sales ($mm) Increasing Use of Hand Sanitizer Driving Incremental Demand 17 Source: The Insight Partners Analysis Hand Sanitizer Sales by Type Growth in hand sanitizer sales could provide a powerful tailwind to specialty alcohol sales for the foreseeable future and demand may increase as schools, businesses and entertainment venues reopen Two thirds of hand sanitizer is alcohol - based Hand Sanitizer Sales by Application Hospitals 45.6% Household 19.8% Offices / Other 14.7% Restaurants 12.5% Education 7.4% Hand sanitizer is used by a wide range of businesses and institutions

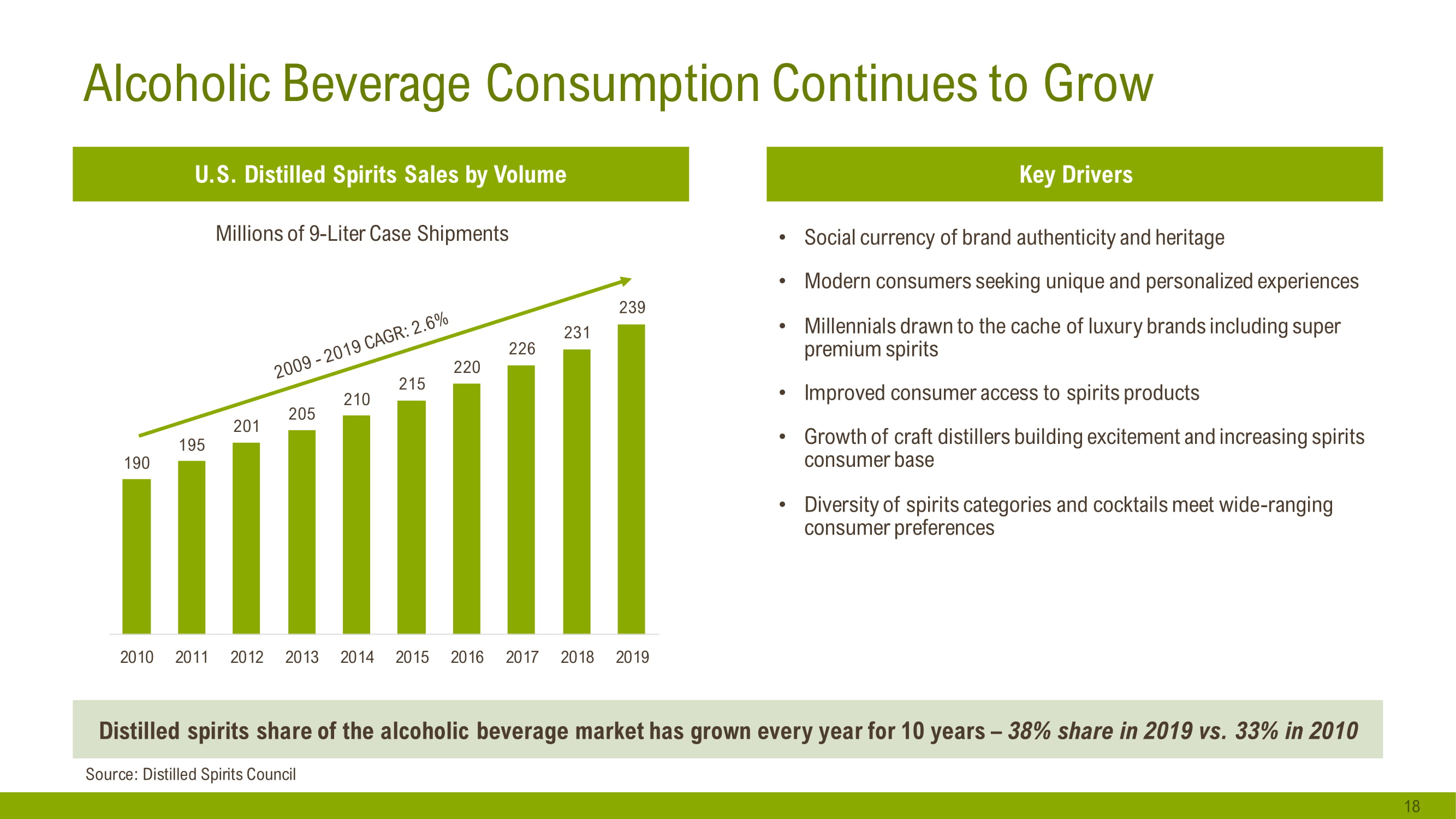

190 195 201 205 210 215 220 226 231 239 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Alcoholic Beverage Consumption Continues to Grow 18 U.S. Distilled Spirits Sales by Volume Key Drivers • Social currency of brand authenticity and heritage • Modern consumers seeking unique and personalized experiences • Millennials drawn to the cache of luxury brands including super premium spirits • Improved consumer access to spirits products • Growth of craft distillers building excitement and increasing spirits consumer base • Diversity of spirits categories and cocktails meet wide - ranging consumer preferences Distilled spirits share of the alcoholic beverage market has grown every year for 10 years – 38% share in 2019 vs. 33% in 2010 Source: Distilled Spirits Council Millions of 9 - Liter Case Shipments

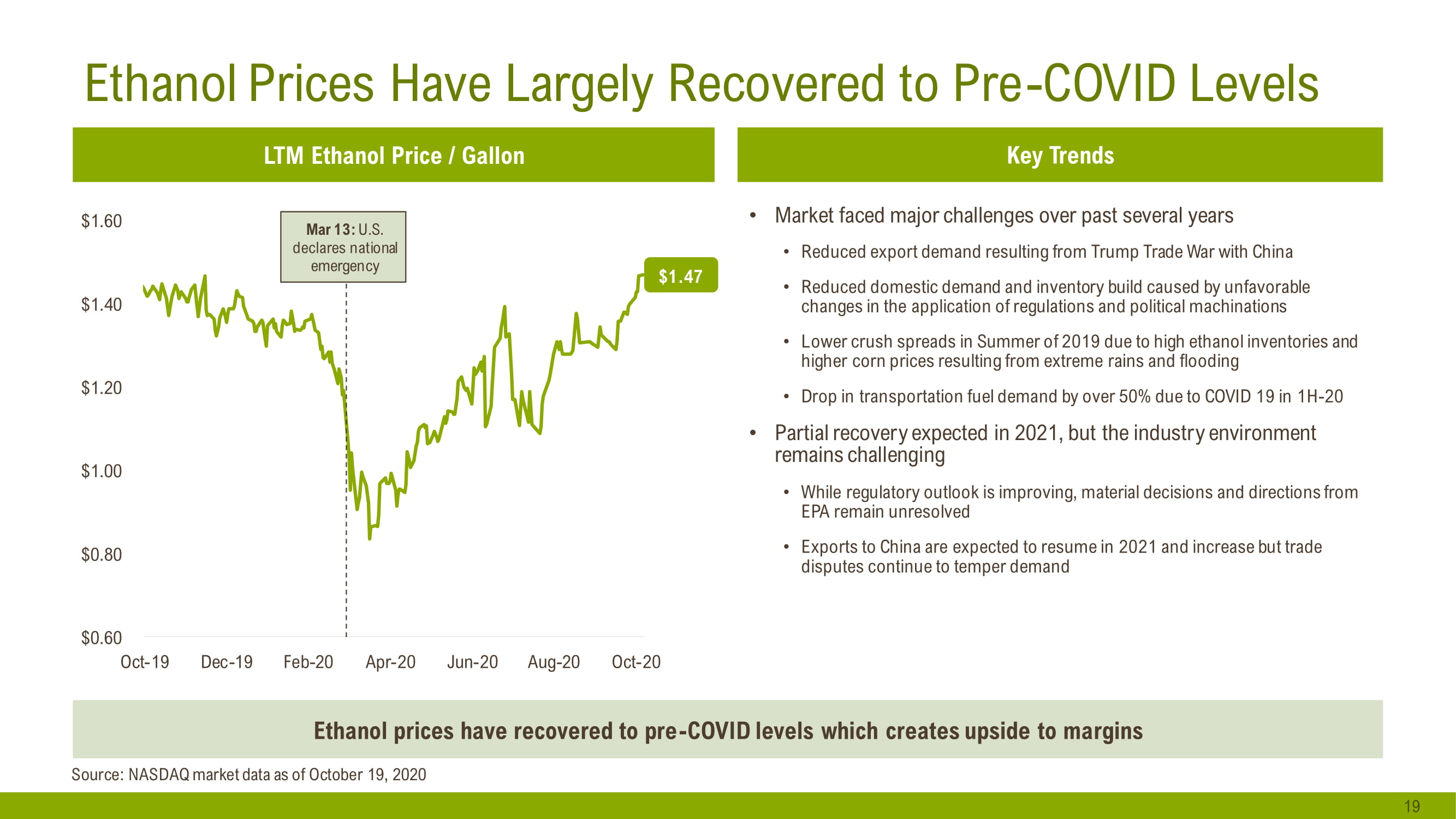

$0.60 $0.80 $1.00 $1.20 $1.40 $1.60 Oct-19 Dec-19 Feb-20 Apr-20 Jun-20 Aug-20 Oct-20 Ethanol Prices Have Largely Recovered to Pre - COVID Levels 19 Source: NASDAQ market data as of October 19, 2020 Ethanol prices have recovered to pre - COVID levels which creates upside to margins LTM Ethanol Price / Gallon Key Trends • Market faced major challenges over past several years • Reduced export demand resulting from Trump Trade War with China • Reduced domestic demand and inventory build caused by unfavorable changes in the application of regulations and political machinations • Lower crush spreads in Summer of 2019 due to high ethanol inventories and higher corn prices resulting from extreme rains and flooding • Drop in transportation fuel demand by over 50% due to COVID 19 in 1H - 20 • Partial recovery expected in 2021, but the industry environment remains challenging • While regulatory outlook is improving, material decisions and directions from EPA remain unresolved • Exports to China are expected to resume in 2021 and increase but trade disputes continue to temper demand $1.47 Mar 13: U.S. declares national emergency

3. Strategy 20

The “Four Pillars” of Our Go Forward Strategy Broaden Addressable Market by Obtaining Certifications 2 Sell or Repurpose Western Plants 1 Further Increase Efficiency and Reduce Costs at Pekin Campus 3 Expand Into Complementary Products & Market Segments 4 21 Near - term Focus

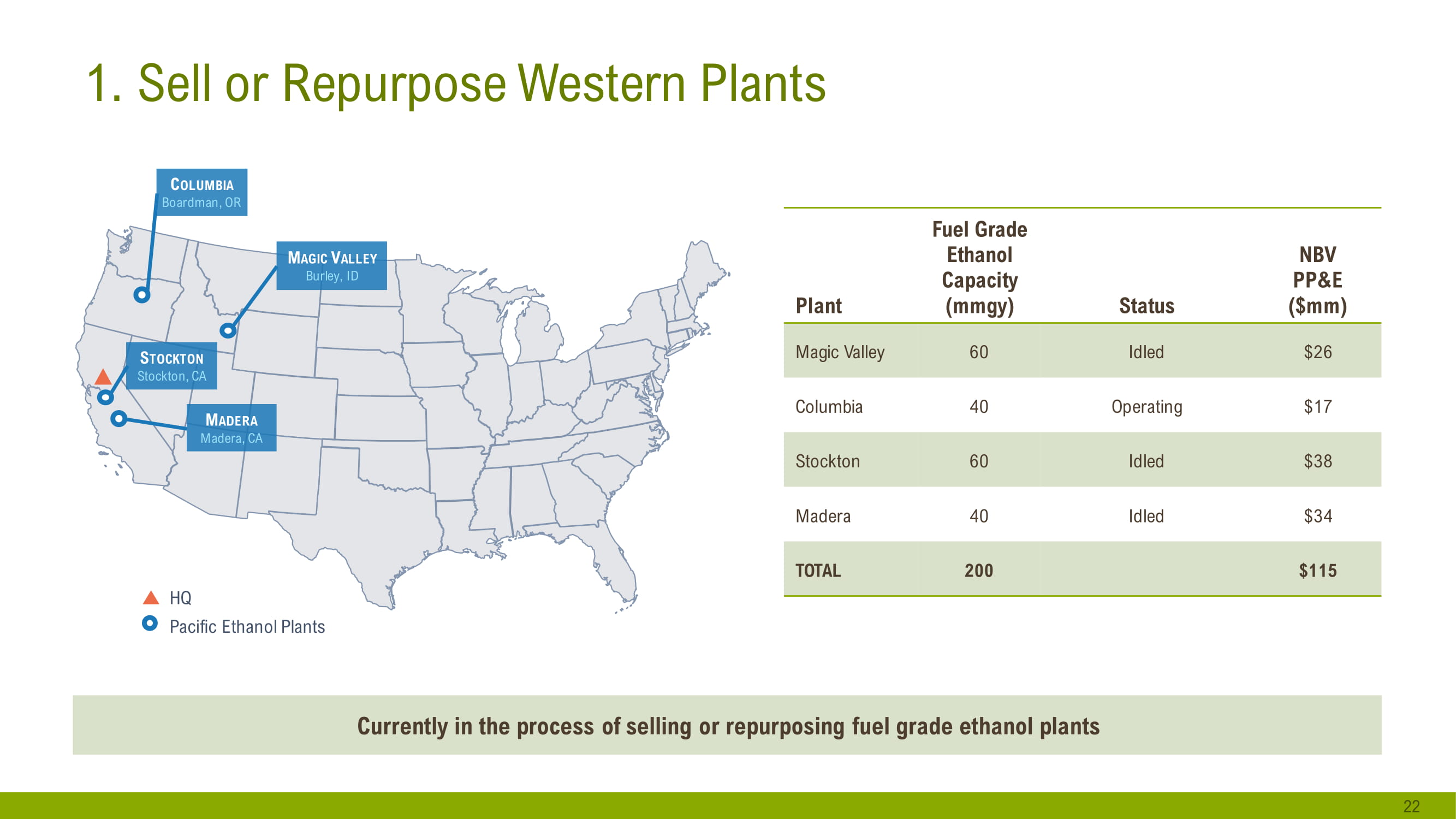

1. Sell or Repurpose Western Plants 22 Plant Fuel Grade Ethanol Capacity (mmgy) Status NBV PP&E ($mm) Magic Valley 60 Idled $26 Columbia 40 Operating $17 Stockton 60 Idled $38 Madera 40 Idled $34 TOTAL 200 $115 C OLUMBIA Boardman, OR S TOCKTON Stockton, CA M ADERA Madera, CA M AGIC V ALLEY Burley, ID HQ Pacific Ethanol Plants Currently in the process of selling or repurposing fuel grade ethanol plants

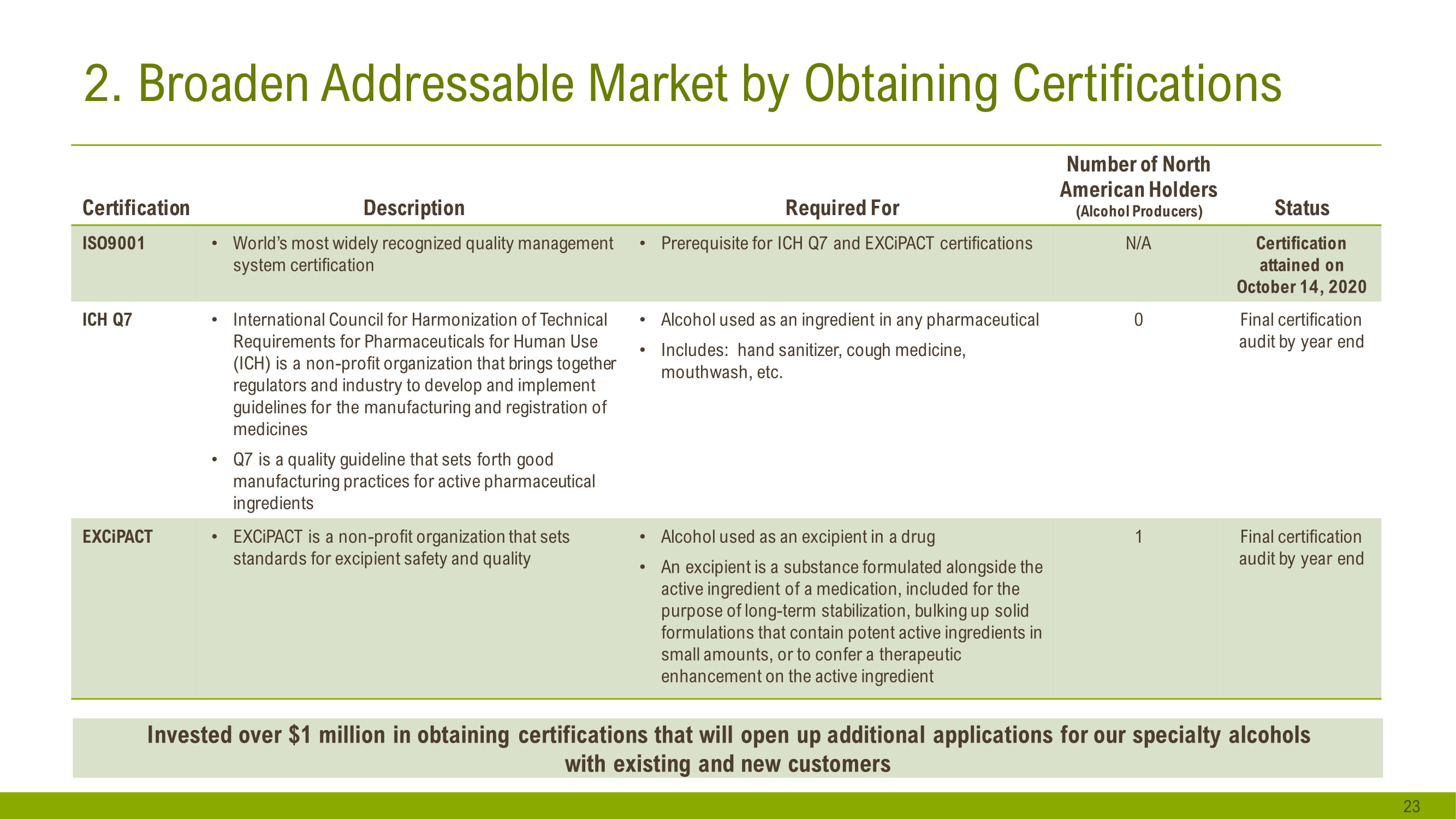

2. Broaden Addressable Market by Obtaining Certifications Certification Description Required For Number of North American Holders (Alcohol Producers) Status ISO9001 • World’s most widely recognized quality management system certification • Prerequisite for ICH Q7 and EXCiPACT certifications N/A Certification attained on October 14, 2020 ICH Q7 • International Council for Harmonization of Technical Requirements for Pharmaceuticals for Human Use (ICH) is a non - profit organization that brings together regulators and industry to develop and implement guidelines for the manufacturing and registration of medicines • Q7 is a quality guideline that sets forth good manufacturing practices for active pharmaceutical ingredients • Alcohol used as an ingredient in any pharmaceutical • Includes: hand sanitizer, cough medicine, mouthwash, etc. 0 Final certification audit by year end EXCiPACT • EXCiPACT is a non - profit organization that sets standards for excipient safety and quality • Alcohol used as an excipient in a drug • An excipient is a substance formulated alongside the active ingredient of a medication, included for the purpose of long - term stabilization, bulking up solid formulations that contain potent active ingredients in small amounts, or to confer a therapeutic enhancement on the active ingredient 1 Final certification audit by year end 23 Invested over $1 million in obtaining certifications that will open up additional applications for our specialty alcohols with existing and new customers

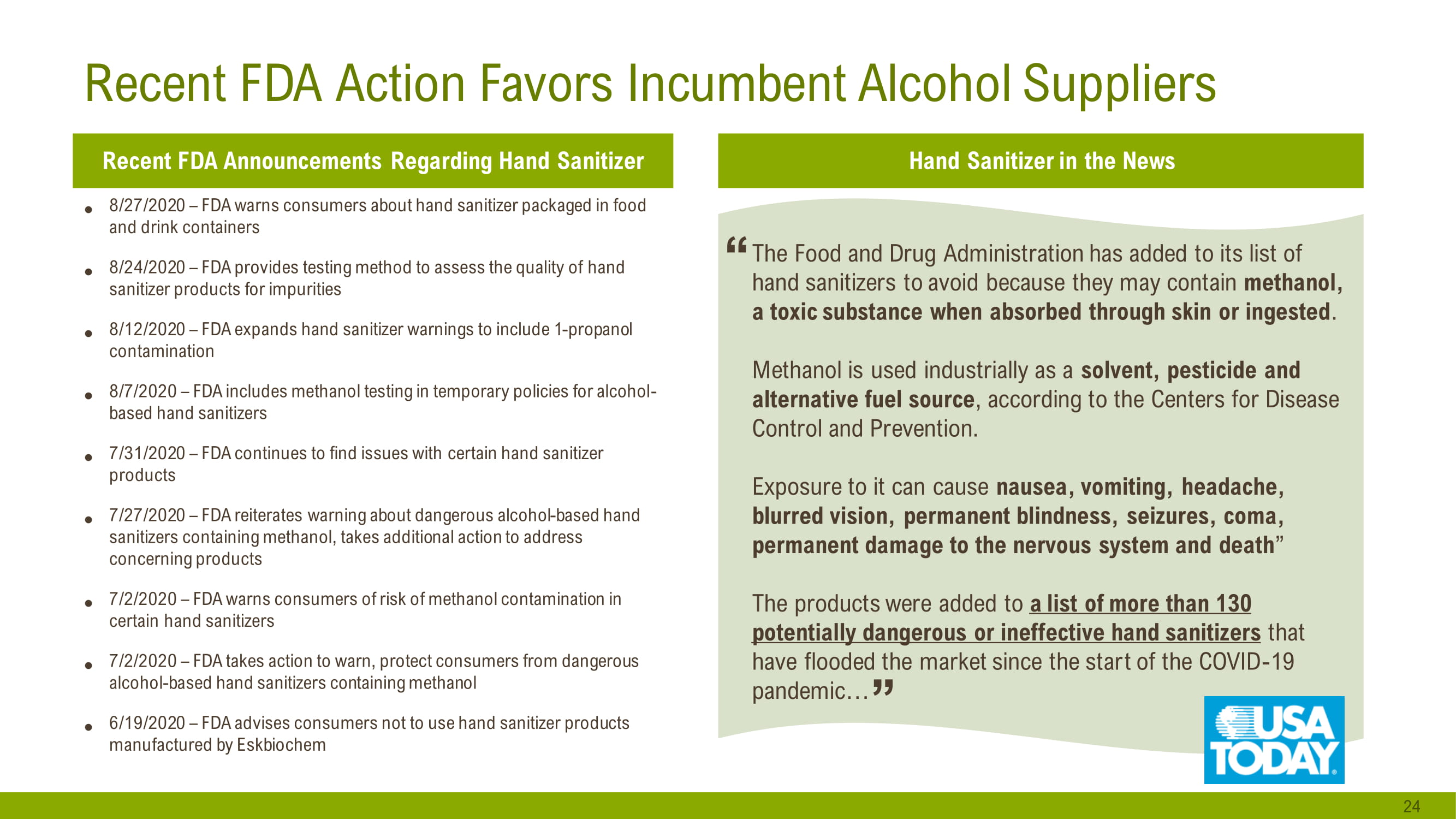

Recent FDA Action Favors Incumbent Alcohol Suppliers 24 Recent FDA Announcements Regarding Hand Sanitizer Hand Sanitizer in the News The Food and Drug Administration has added to its list of hand sanitizers to avoid because they may contain methanol, a toxic substance when absorbed through skin or ingested . Methanol is used industrially as a solvent, pesticide and alternative fuel source , according to the Centers for Disease Control and Prevention. Exposure to it can cause nausea, vomiting, headache, blurred vision, permanent blindness, seizures, coma, permanent damage to the nervous system and death ” The products were added to a list of more than 130 potentially dangerous or ineffective hand sanitizers that have flooded the market since the start of the COVID - 19 pandemic… “ ” • 8/27/2020 – FDA warns consumers about hand sanitizer packaged in food and drink containers • 8/24/2020 – FDA provides testing method to assess the quality of hand sanitizer products for impurities • 8/12/2020 – FDA expands hand sanitizer warnings to include 1 - propanol contamination • 8/7/2020 – FDA includes methanol testing in temporary policies for alcohol - based hand sanitizers • 7/31/2020 – FDA continues to find issues with certain hand sanitizer products • 7/27/2020 – FDA reiterates warning about dangerous alcohol - based hand sanitizers containing methanol, takes additional action to address concerning products • 7/2/2020 – FDA warns consumers of risk of methanol contamination in certain hand sanitizers • 7/2/2020 – FDA takes action to warn, protect consumers from dangerous alcohol - based hand sanitizers containing methanol • 6/19/2020 – FDA advises consumers not to use hand sanitizer products manufactured by Eskbiochem

4. Financial Overview 25

($12) $29 $34 Q1 Q2 Preliminary Q3 2020 Quarterly Financial Summary 26 Impact of business transformation Adjusted EBITDA ($mm) (1) Revenues ($mm) $311 $212 $204 Q1 Q2 Preliminary Q3 (1) Please see Appendix for information related to use of non - GAAP measures Impact of idling Western Plants

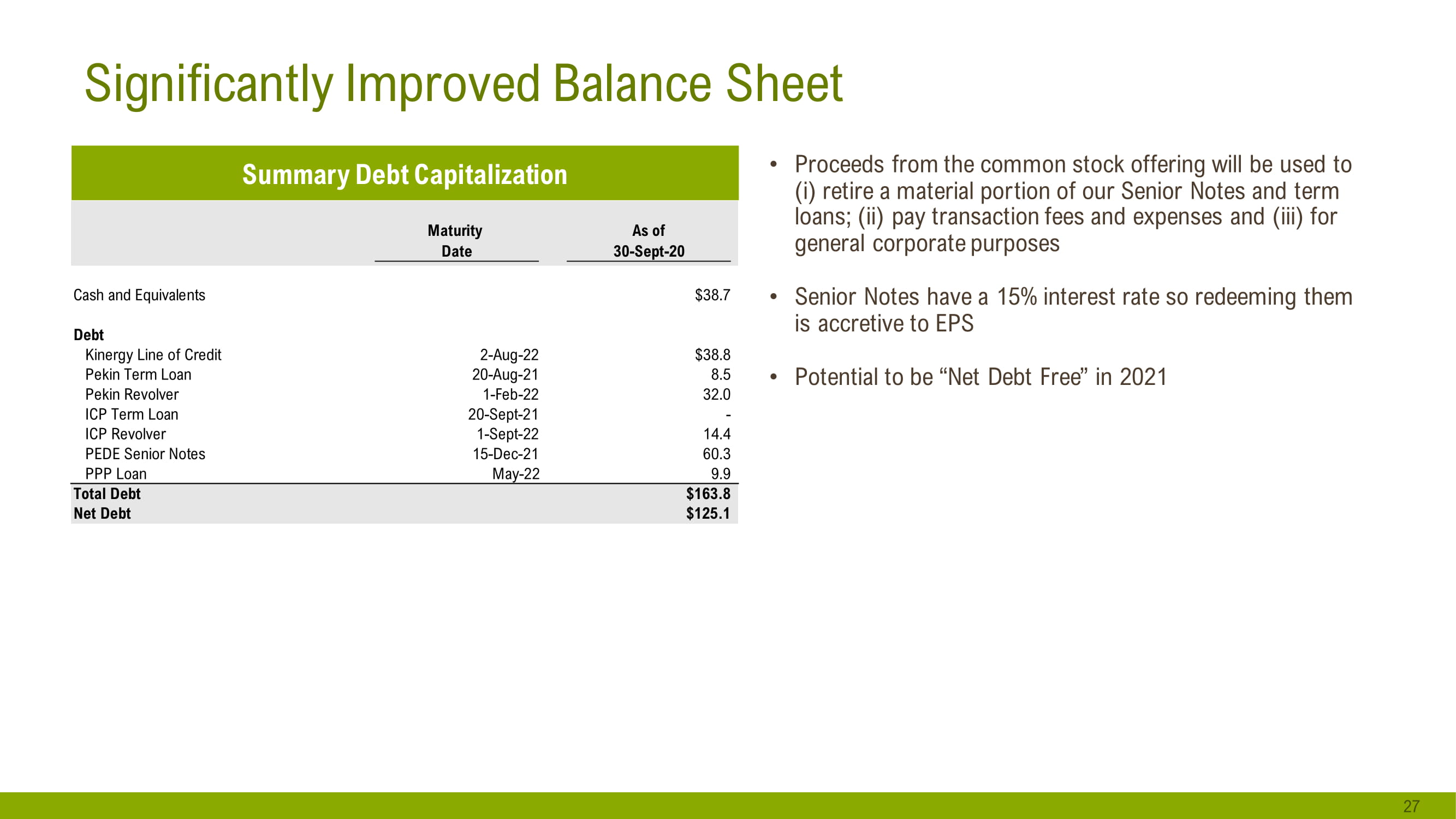

Significantly Improved Balance Sheet 27 Summary Debt Capitalization • Proceeds from the common stock offering will be used to (i) retire a material portion of our Senior Notes and term loans; (ii) pay transaction fees and expenses and (iii) for general corporate purposes • Senior Notes have a 15% interest rate so redeeming them is accretive to EPS • Potential to be “Net Debt Free” in 2021 Maturity As of Date 30-Sept-20 Cash and Equivalents $38.7 Debt Kinergy Line of Credit 2-Aug-22 $38.8 Pekin Term Loan 20-Aug-21 8.5 Pekin Revolver 1-Feb-22 32.0 ICP Term Loan 20-Sept-21 - ICP Revolver 1-Sept-22 14.4 PEDE Senior Notes 15-Dec-21 60.3 PPP Loan May-22 9.9 Total Debt $163.8 Net Debt $125.1 Shareholders' Equity 245.2 Total Shareholders' Equity $245.2 Total Debt & Shareholders' Equity $409.0

Summary & Wrap - up 28

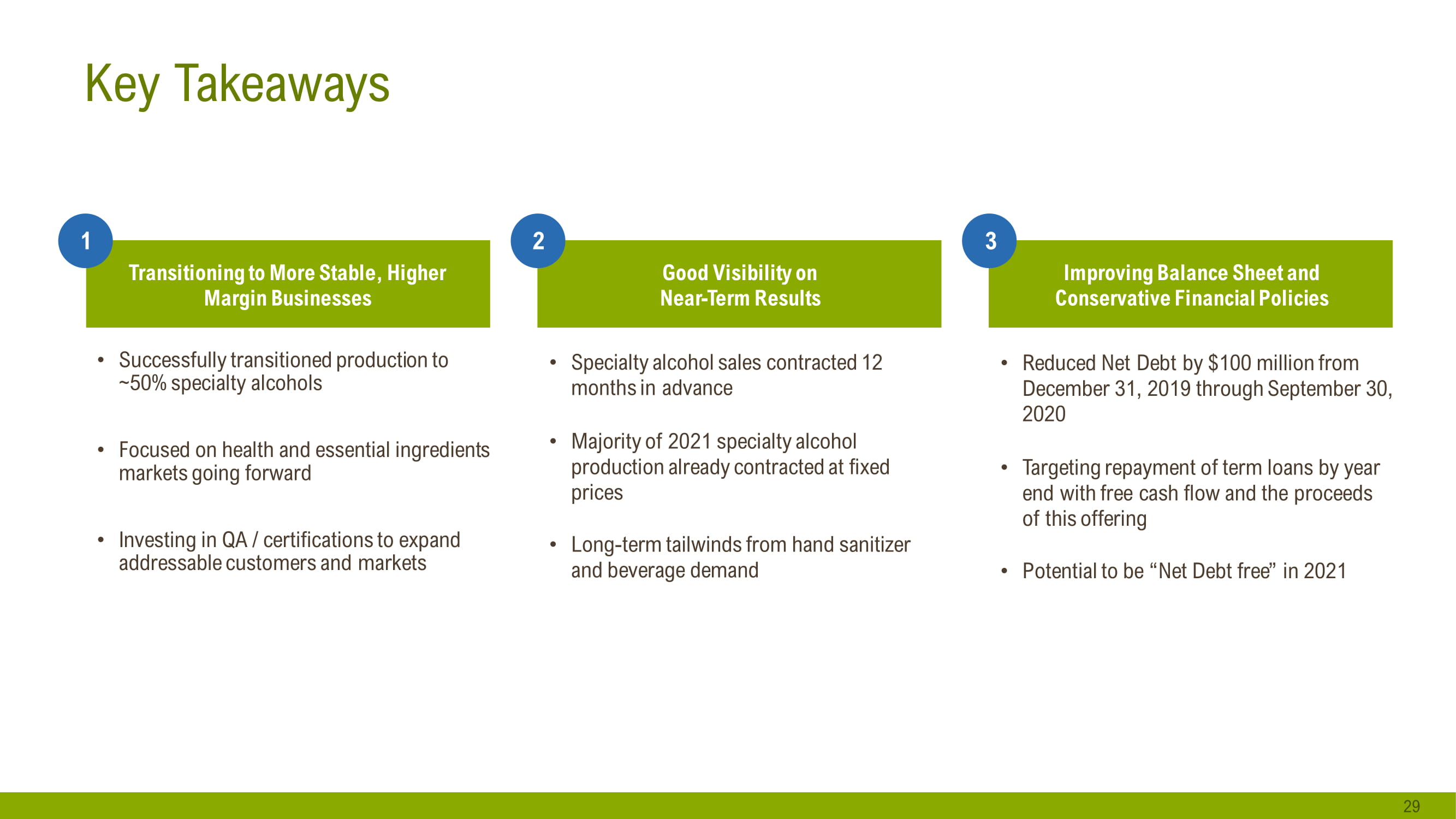

Key Takeaways • Successfully transitioned production to ~50% specialty alcohols • Focused on health and essential ingredients markets going forward • Investing in QA / certifications to expand addressable customers and markets 29 Transitioning to More Stable, Higher Margin Businesses 1 Good Visibility on Near - Term Results 2 Improving Balance Sheet and Conservative Financial Policies 3 • Specialty alcohol sales contracted 12 months in advance • Majority of 2021 specialty alcohol production already contracted at fixed prices • Long - term tailwinds from hand sanitizer and beverage demand • Reduced Net Debt by $100 million from December 31, 2019 through September 30, 2020 • Targeting repayment of term loans by year end with free cash flow and the proceeds of this offering • Potential to be “Net Debt free” in 2021

Appendix 30

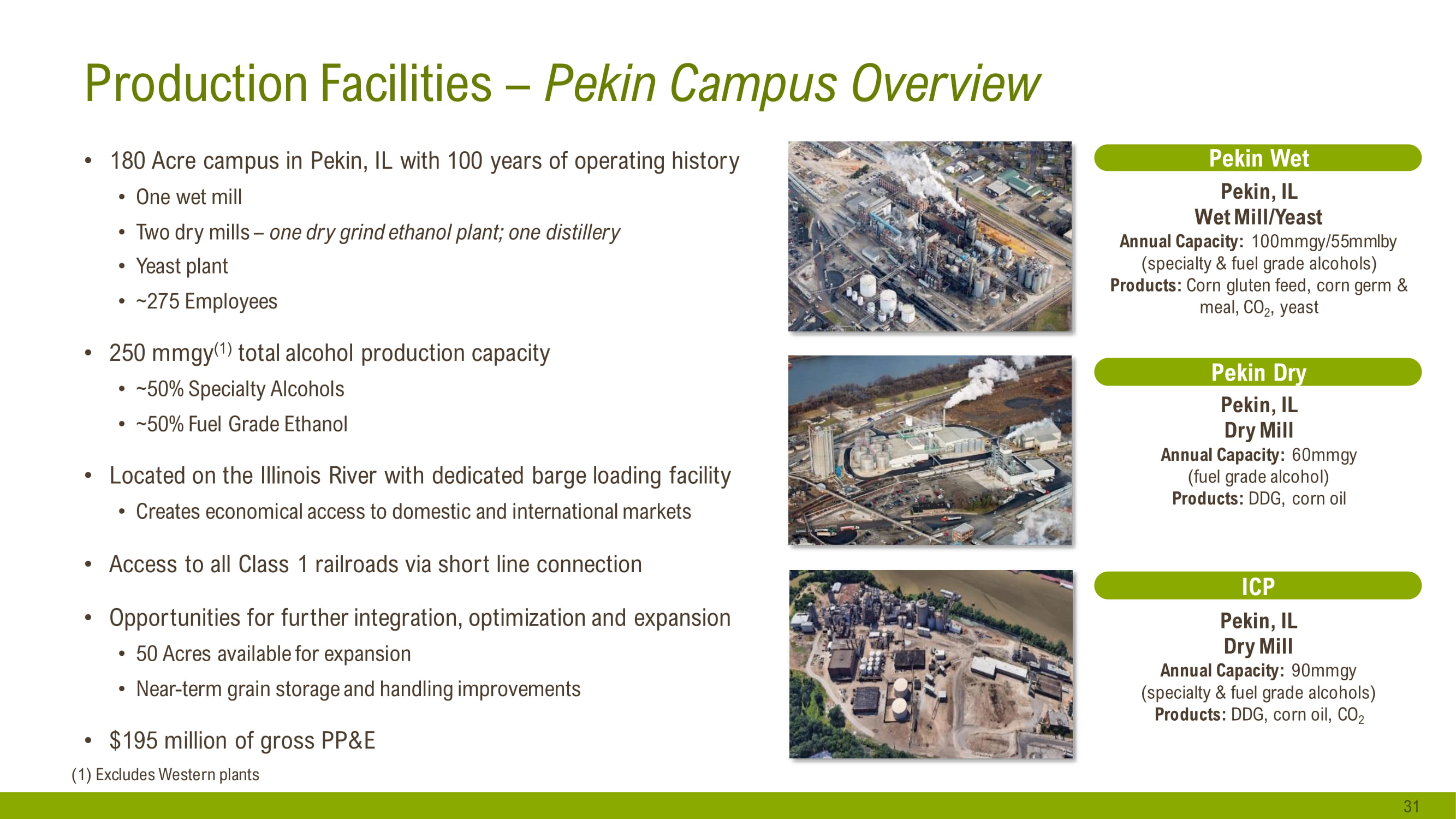

Production Facilities – Pekin Campus Overview 31 • 180 Acre campus in Pekin, IL with 100 years of operating history • One wet mill • Two dry mills – one dry grind ethanol plant; one distillery • Yeast plant • ~275 Employees • 250 mmgy (1) total alcohol production capacity • ~50% Specialty Alcohols • ~50% Fuel Grade Ethanol • Located on the Illinois River with dedicated barge loading facility • Creates economical access to domestic and international markets • Access to all Class 1 railroads via short line connection • Opportunities for further integration, optimization and expansion • 50 Acres available for expansion • Near - term grain storage and handling improvements • $195 million of gross PP&E ICP Pekin, IL Dry Mill Annual Capacity: 90mmgy (specialty & fuel grade alcohols) Products: DDG, corn oil, CO 2 Pekin Wet Pekin, IL Wet Mill/Yeast Annual Capacity: 100mmgy/55mmlby (specialty & fuel grade alcohols) Products: Corn gluten feed, corn germ & meal, CO 2 , yeast Pekin Dry Pekin, IL Dry Mill Annual Capacity: 60mmgy (fuel grade alcohol) Products: DDG, corn oil (1) Excludes Western plants

Use of Non - GAAP Measures 32 Management believes that certain financial measures not in accordance with generally accepted accounting principles ("GAAP") are useful measures of operations . The company defines Adjusted EBITDA as unaudited net income (loss) attributed to Pacific Ethanol, Inc . before interest expense, provision (benefit) for income taxes, asset impairments, loss on extinguishment of debt, purchase accounting adjustments, fair value adjustments, and depreciation and amortization expense . A table is provided at the end of this release that provides a reconciliation of Adjusted EBITDA to its most directly comparable GAAP measure, net income (loss) attributed to Pacific Ethanol, Inc . Management provides this non - GAAP measure so that investors will have the same financial information that management uses, which may assist investors in properly assessing the company's performance on a period - over - period basis . Adjusted EBITDA is not a measure of financial performance under GAAP and should not be considered as an alternative to net income (loss) attributed to Pacific Ethanol, Inc . or any other measure of performance under GAAP, or to cash flows from operating, investing or financing activities as an indicator of cash flows or as a measure of liquidity . Adjusted EBITDA has limitations as an analytical tool and you should not consider this measure in isolation or as a substitute for analysis of the company's results as reported under GAAP .