Filed by Pacific Ethanol, Inc.

Pursuant to Rule 425 under

the Securities Act of 1933

and deemed filed pursuant to Rule 14a-6 under

the Securities Exchange Act of 1934

Subject Company: Aventine Renewable Energy Holdings, Inc.

(Commission File No. 001-32922)

This filing relates to a proposed business combination involving Pacific Ethanol, Inc. and Aventine Renewable Energy Holdings, Inc.

1 Leading Producer and Marketer of Low - Carbon Renewable Fuels Strong Long - term Demand for Ethanol Pacific Ethanol First Quarter 2015 Financial Results Differentiated Business Model & Diversified Revenue Streams

2 2 Statements contained in this communication that refer to Pacific Ethanol’s estimated or anticipated future results or other non - historical expressions of fact are forward - looking statements that reflect Pacific Ethanol’s current perspective of existing trends and inf ormation as of the date of this communication. Forward looking statements generally will be accompanied by words such as “anticipate,” “believe, ” “ plan,” “could,” “should,” “estimate,” “expect,” “forecast,” “outlook,” “guidance,” “intend,” “may,” “might,” “will,” “possible,” “potential,” “p redict,” “project,” or other similar words, phrases or expressions. Such forward - looking statements include, but are not limited to, the ability of Pac ific Ethanol to timely and successfully execute on, and the effects of, its initiatives to improve plant efficiencies and increase yields, reduce pr odu ction costs, diversify feedstock, diversify its revenue streams and generate additional revenue, and produce advanced biofuels; market conditions, i ncl uding the supply of and demand for ethanol and co - products, as well as margins, commodity prices, and export conditions; the timing and effects o f corn oil production; Pacific Ethanol’s ability to efficiently balance its debt and cash balances, reduce borrowing costs and consolida te and refinance its total debt, including Aventine’s debt; statements about the benefits of the Aventine merger, including future financial and operati ng results, Pacific Ethanol’s or Aventine’s plans, objectives, expectations and intentions and the expected timing of completion of the transacti on. It is important to note that Pacific Ethanol’s goals and expectations are not predictions of actual performance. Actual results may differ mater ial ly from Pacific Ethanol’s current expectations depending upon a number of factors affecting Pacific Ethanol’s business, Aventine’s business a nd risks associated with merger transactions. These factors include, among others, adverse economic and market conditions, including for ethanol and its co - products; raw material costs, including ethanol production input costs; changes in governmental regulations and policies; and insuffici ent capital resources. These factors also include, among others, the inherent uncertainty associated with financial projections; restructuring in co nne ction with, and successful closing of, the Aventine merger; subsequent integration of Aventine and the ability to recognize the anticipated s yne rgies and benefits of the Aventine merger; the ability to obtain required regulatory approvals for the transaction (including the approval of antit rus t authorities necessary to complete the acquisition), the timing of obtaining such approvals and the risk that such approvals may result in th e imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction; the ability to obtai n t he requisite Pacific Ethanol and Aventine stockholder approvals; the risk that a condition to closing the Aventine merger may not be satisfied on a t imely basis or at all; the failure of the proposed transaction to close for any other reason; risks relating to the value of the Pacific Ethanol sha res to be issued in the transaction; the anticipated size of the markets and continued demand for Pacific Ethanol’s and Aventine’s products; the impa ct of competitive products and pricing; the risks and uncertainties normally incident to the ethanol production and marketing industries; the d iff iculty of predicting the timing or outcome of pending or future litigation or government investigations; changes in generally accepted accounting pri nciples; costs and efforts to defend or enforce intellectual property rights; successful compliance with governmental regulations applicable to Pac ific Ethanol’s and Aventine’s facilities, products and/or businesses; changes in the laws and regulations; changes in tax laws or interpretation s t hat could increase Pacific Ethanol’s consolidated tax liabilities; the loss of key senior management or staff; and such other risks and uncertai nti es detailed in Pacific Ethanol’s periodic public filings with the Securities and Exchange Commission, including but not limited to Pacific Ethanol’s “R isk Factors” section contained in Pacific Ethanol’s Form 10 - Q filed with the Securities and Exchange Commission on May 11, 2015 and from time to time in Pacific Ethanol’s other investor communications. Except as expressly required by law, Pacific Ethanol disclaims any intent or obligat ion to update or revise these forward - looking statements. Cautionary Statements

3 3 Additional Information This communication is being made partially in respect of the proposed merger between Pacific Ethanol, Inc. and Aventine Renewable Energy Holdings, Inc. In connection with the proposed merger, Pacific Ethanol has filed with the Securities and Exchange Commission a registration statement on Form S - 4 that includes a definitive joint proxy statement of Pacific Ethanol and Aventine that also constitutes a prospectus of Pacific Ethanol. The definitive joint proxy statement/prospectus will be delivered to the stockholders of Pacific Ethanol and Aventine. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. Investors and security holders may obtain free copies of the registration statement and the definitive joint proxy statement/prospectus and other documents filed with the Securities and Exchange Commission by Pacific Ethanol through the website maintained by the Securities and Exchange Commission at http://www.sec.gov . Copies of the documents filed with the Securities and Exchange Commission by Pacific Ethanol are also available free of charge on Pacific Ethanol’s internet website at www.pacificethanol.com or by contacting Pacific Ethanol’s investor relations agency, LHA, at (415) 433 - 3777. Pacific Ethanol, Aventine, their respective directors and certain of their executive officers and employees may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of Pacific Ethanol is set forth in the definitive joint proxy statement/prospectus. Additional information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the definitive joint proxy statement/prospectus filed with the above - referenced registration statement on Form S - 4. A more complete description is available in the registration statement and the definitive joint proxy statement/prospectus.

4 4 First Quarter 2015 Summary Recorded net loss of $4.7 million reflecting… Higher ethanol industry inventory levels S easonally lower transportation fuel demand Compressed production margins Efforts to diversify revenue streams, improve plant efficiencies & strengthen balance sheet helped mitigate the negative impacts from seasonal downturns

5 5 Focusing on Long - term Profitability Diversifying Revenue Installing corn oil separation technology Now producing at Madera Expect to begin production in Boardman during Q2 Increasing corn yield over time by investing in mechanical technology such as fine grinding & optimizing enzyme & chemical treatments Many additional projects in various phases of development aimed at reducing production costs Improving Plant Efficiencies

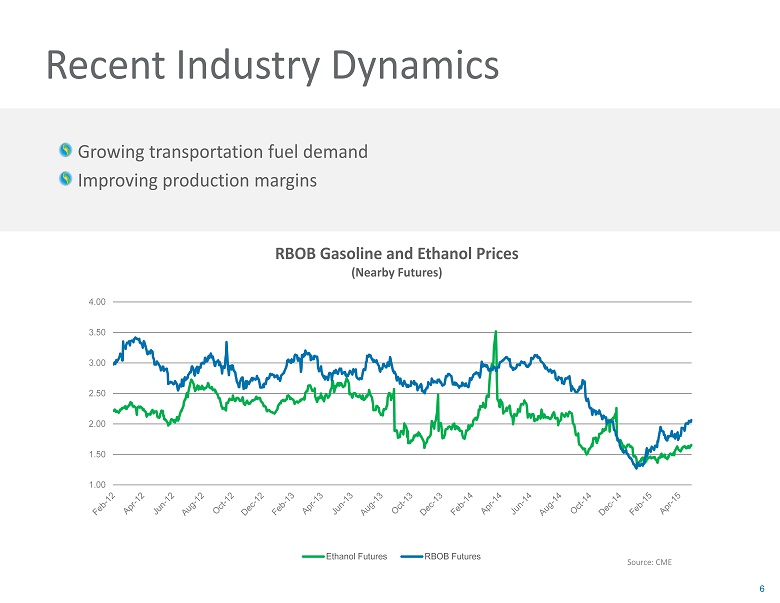

6 6 Recent Industry Dynamics Growing transportation fuel demand Improving production margins Source: CME 1.00 1.50 2.00 2.50 3.00 3.50 4.00 RBOB Gasoline and Ethanol Prices (Nearby Futures) Ethanol Futures RBOB Futures

7 7 Aventine Merger Agreement Highlights On Dec. 31, 2014, Pacific Ethanol, Inc. and Aventine Renewable Energy Holdings, Inc. announced a definitive merger agreement under which Pacific Ethanol is to acquire all of the outstanding shares of Aventine in a stock - for - stock merger. Connects Destination & Origin Market Strategies, Providing Synergies in Production & Marketing Expands Marketing Reach into New Markets & Broadens Scale Increases Combined Annual Production Capacity to 515 MGY with Marketing Volume to 800 MGY

8 Growing Demand: Ethanol & Co - Products Providing ongoing economic value Ethanol remains cheapest form of octane Provides consumers with important choice at the pump Ethanol in Demand in Export Markets Year - to - date exports through March totaled 234 million gallons Favorable co - product values Total exports of 11.3 million metric tons of distillers grains in 2014, representing one - third of domestic production Late 2014, China eased import restrictions for distillers grain, reopening a very lucrative market Corn oil adds $0.05 per gallon of incremental operating income

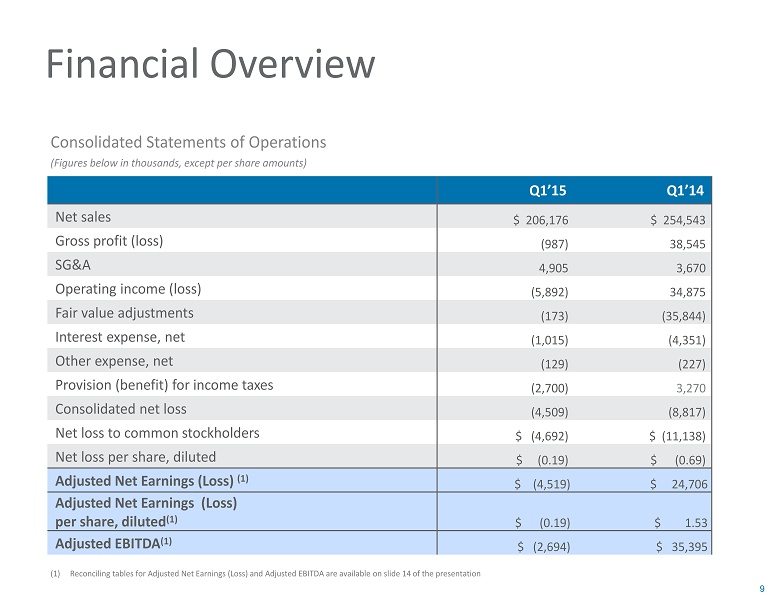

9 9 Q1’15 Q1’14 Net sales $ 206,176 $ 254,543 Gross profit (loss) (987) 38,545 SG&A 4,905 3,670 Operating income (loss) (5,892) 34,875 Fair value adjustments (173) (35,844) Interest expense, net (1,015) (4,351) Other expense, net (129) (227) Provision (benefit) for income taxes (2,700) 3,270 Consolidated net loss (4,509) (8,817) Net loss to common stockholders $ (4,692) $ (11,138) Net loss per share, diluted $ (0.19) $ (0.69) Adjusted Net Earnings (Loss) (1) $ (4,519) $ 24,706 Adjusted Net Earnings (Loss) per share, diluted (1) $ (0.19) $ 1.53 Adjusted EBITDA (1) $ (2,694) $ 35,395 Financial Overview (1) R econciling tables for Adjusted Net Earnings (Loss) and Adjusted EBITDA are available on slide 14 of the presentation (Figures below in thousands, except per share amounts) Consolidated Statements of Operations

10 10 At: March 31, 2015 December 31, 2014 Cash & cash equivalents $ 42,274 $ 62,084 Current assets $110,565 $139,551 Total assets $ 275,225 $ 299,502 Current liabilities $ 22,839 $ 25,447 Total liabilities $ 61,328 $ 81,520 Stockholders’ equity $213,897 $217,982 Total liabilities & stockholders’ equity $ 275,225 $ 299,502 Balance Sheet Highlights (Figures below in thousands)

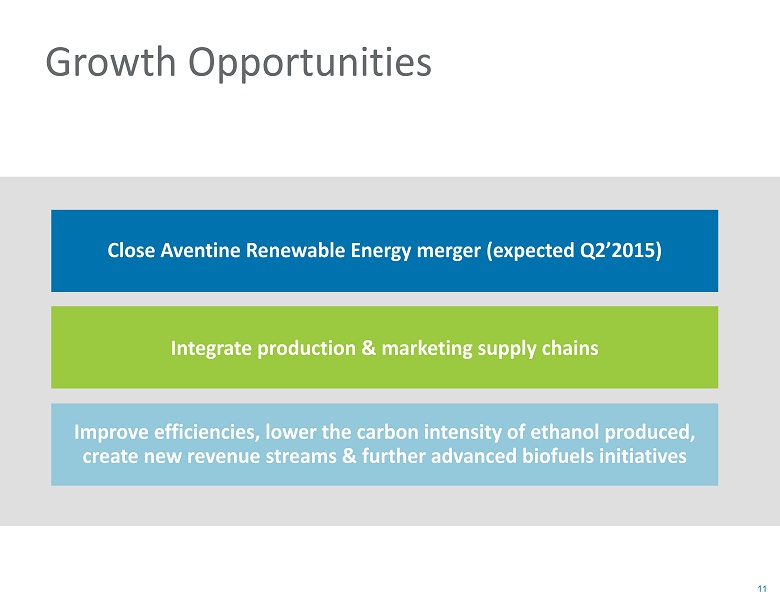

11 11 Close Aventine Renewable Energy merger (expected Q2’2015) Improve efficiencies, lower the carbon intensity of ethanol produced, create new revenue streams & further advanced biofuels initiatives Growth Opportunities Integrate production & marketing supply chains

12 Appendix Thank You

13 13 Use of Non - GAAP Measures Management believes that certain financial measures not in accordance with generally accepted accounting principles (“GAAP”) are useful measures of operations . The company defines Adjusted Net Earnings (Loss) as unaudited earnings (loss ) before fair value adjustments and warrant inducements and gain (loss) on extinguishments of debt. The company defines Adjusted EBITDA as unaudited earnings (loss ) before interest, provision for income taxes, depreciation and amortization, fair value adjustments and warrant inducements and nonca sh gain (loss) on extinguishments of debt. Tables are provided at the end of this presentation that provide a reconciliation of Adjusted Net Earnings (Loss) and Adjusted EBITDA to their most directly comparable GAAP measures. Management provides these non - GAAP measures so that investors will have the same financial information that management uses, which may assist investors in prope rly assessing the company’s performance on a period - over - period basis. Adjusted Net Earnings (Loss) and Adjusted EBITDA are not measures of financial performance under GAAP, and should not be considered alternatives to net income (loss) or any other measure of performance under GAAP, or to cash flows from operating, investing or financing activities as an indicator of cash fl ows or as a measure of liquidity. Adjusted Net Earnings (Loss) and Adjusted EBITDA have limitations as analytical tools and you should not consider these measures in isolation or as a substitute for analysis of the company’s results as reported under GAAP.

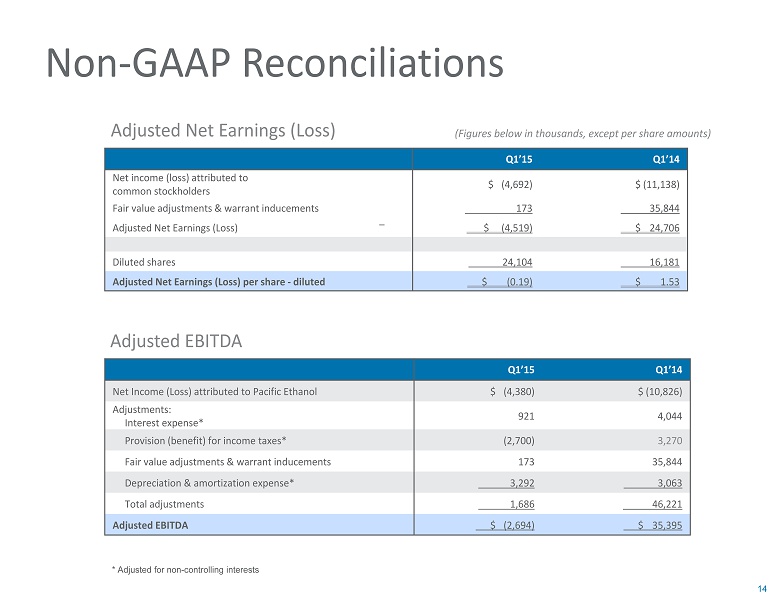

14 14 * Adjusted for non - controlling interests Non - GAAP Reconciliations Q1’15 Q1’14 Net Income (Loss) attributed to Pacific Ethanol $ (4,380) $ (10,826) Adjustments: Interest expense* 921 4,044 Provision (benefit) for income taxes* (2,700) 3,270 Fair value adjustments & warrant inducements 173 35,844 Depreciation & amortization expense* 3,292 3,063 Total adjustments 1,686 46,221 Adjusted EBITDA $ (2,694) $ 35,395 (Figures below in thousands, except per share amounts) Adjusted EBITDA Adjusted Net Earnings (Loss) Q1’15 Q1’14 Net income (loss) attributed to common stockholders $ (4,692) $ (11,138) Fair value adjustments & warrant inducements 173 35,844 Adjusted Net Earnings (Loss) $ (4,519) $ 24,706 Diluted shares 24,104 16,181 Adjusted Net Earnings (Loss) per share - diluted $ (0.19) $ 1.53 _