Filed by Pacific Ethanol, Inc.

Pursuant to Rule 425 under

the Securities Act of 1933

and deemed filed pursuant to Rule 14a-6 under

the Securities Exchange Act of 1934

Subject Company: Aventine Renewable Energy Holdings, Inc.

(Commission File No. 000-21467)

This filing relates to a proposed business combination involving Pacific Ethanol, Inc. and Aventine Renewable Energy Holdings, Inc.

1 Leading Producer and Marketer of Low - Carbon Renewable Fuels Strong Long - term Demand for Ethanol Pacific Ethanol Business Update Call: January 7, 2015 Differentiated Business Model & Diversified Revenue Streams

2 2 Statements contained in this communication that refer to Pacific Ethanol’s estimated or anticipated future results, including estimated synergies, or other non - historical expressions of fact are forward - looking statements that reflect Pacific Ethanol’s current perspective of existing trends and information as of the date of this communication. Forward looking statements generally will be accompanied by words such as “anticipate,” “believe,” “plan,” “could,” “should,” “estimate,” “expect,” “for eca st,” “outlook,” “guidance,” “intend,” “may,” “might,” “will,” “possible,” “potential,” “predict,” “project,” or other similar word s, phrases or expressions. Such forward - looking statements include, but are not limited to, statements about the benefits of the acquisitio n of Aventine, including future financial and operating results, Pacific Ethanol’s or Aventine’s plans, objectives, expectation s a nd intentions and the expected timing of completion of the transaction. It is important to note that Pacific Ethanol’s goals and expectations are not predictions of actual performance. Actual results may differ materially from Pacific Ethanol’s current expectations depending upon a number of factors affecting Pacific Ethanol’s business, Aventine’s business and risks associate d with acquisition transactions. These factors include, among others, the inherent uncertainty associated with financial projec tio ns; restructuring in connection with, and successful closing of, the Aventine acquisition; subsequent integration of the Aventine acquisition and the ability to recognize the anticipated synergies and benefits of the Aventine acquisition; the ability to o bta in required regulatory approvals for the transaction (including the approval of antitrust authorities necessary to complete the acquisition), the timing of obtaining such approvals and the risk that such approvals may result in the imposition of conditi ons that could adversely affect the combined company or the expected benefits of the transaction; the ability to obtain the requi sit e Pacific Ethanol and Aventine stockholder approvals; the risk that a condition to closing of the Aventine acquisition may not be satisfied on a timely basis or at all; the failure of the proposed transaction to close for any other reason; risks relating to the value of the Pacific Ethanol shares to be issued in the transaction; the anticipated size of the markets and continued demand for P aci fic Ethanol’s and Aventine’s products; the impact of competitive products and pricing; the risks and uncertainties normally incid ent to the ethanol production and marketing industries; the difficulty of predicting the timing or outcome of pending or future litigation or government investigations; changes in generally accepted accounting principles; costs and efforts to defend or enforce intellectual property rights; successful compliance with governmental regulations applicable to Pacific Ethanol’s and Aventine’s facilities, products and/or businesses; changes in the laws and regulations; changes in tax laws or interpretation s t hat could increase Pacific Ethanol’s consolidated tax liabilities; the loss of key senior management or staff; and such other ris ks and uncertainties detailed in Pacific Ethanol’s periodic public filings with the Securities and Exchange Commission, including bu t n ot limited to Pacific Ethanol’s “Risk Factors” section contained in Pacific Ethanol’s Form 10 - Q filed with the Securities and Excha nge Commission on November 12, 2014 and from time to time in Pacific Ethanol’s other investor communications. Except as expressly required by law, Pacific Ethanol disclaims any intent or obligation to update or revise these forward - looking statemen ts. Cautionary Statements

3 3 Additional Information This communication is being made in respect of the proposed merger between Pacific Ethanol, Inc. and Aventine Renewable Energy Holdings, Inc. In connection with the proposed merger, Pacific Ethanol will file with the Securities and Exchange Commission a registration statement on Form S - 4 that will include a joint proxy statement of Pacific Ethanol and Aventine that also constitutes a prospectus of Pacific Ethanol. The definitive joint proxy statement/prospectus will be delivered to the stockholders of Pacific Ethanol and Aventine. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS THAT WILL BE FILED WITH THE SECURITIES AND EXCHANGE COMMISSION CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitati on of any vote or approval. Investors and security holders will be able to obtain free copies of the registration statement and the definitive joint prox y statement/prospectus (when available) and other documents filed with the Securities and Exchange Commission by Pacific Ethanol through the website maintained by the Securities and Exchange Commission at http://www.sec.gov . Copies of the documents filed with the Securities and Exchange Commission by Pacific Ethanol will be available free of charge on Pacific Ethanol’s internet website at www.pacificethanol.com or by contacting Pacific Ethanol’s investor relations agency, LHA, at (415) 433 - 3777. Pacific Ethanol, Aventine, their respective directors and certain of their executive officers and employees may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of Pacific Ethanol is set forth in its proxy statement for its 2014 annual meeting of stockholders, which was filed with the Securities and Exchange Commission on April 28, 2014. Additional information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus filed with the above - referenced registration statement on Form S - 4 and other relevant materials to be filed with the Securities and Exchange Commission when they become available. A more complete description will be available in the registration statement and the joint proxy statement/prospectus.

4 4 Merger Agreement Highlights On Dec. 31, 2014 Pacific Ethanol, Inc. and Aventine Renewable Energy Holdings, Inc. announced a definitive merger agreement under which Pacific Ethanol will acquire all of the outstanding shares of Aventine in a stock - for - stock merger. Expands Unique National Production & Marketing Advantages into New Markets Connects Destination & Origin Market Strategies, Providing Synergies in Production & Marketing Increases Combined Annual Production Capacity to 515 MGY with Marketing Volume to 800 MGY

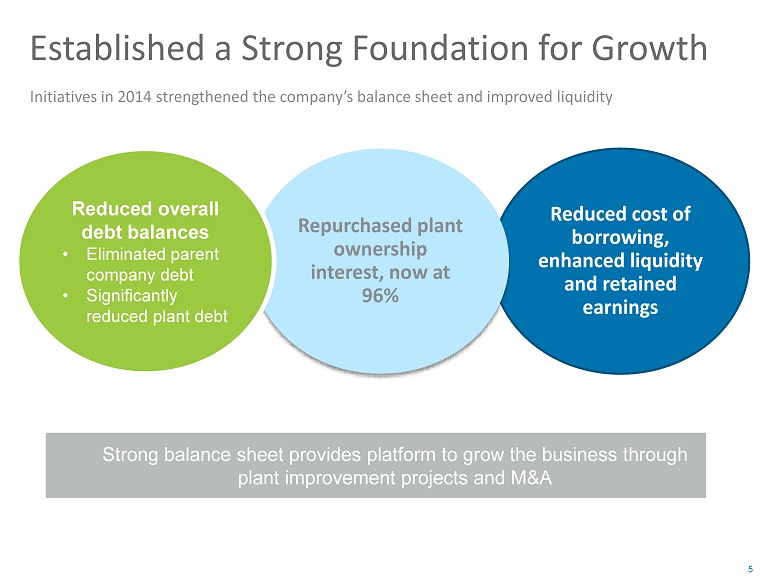

5 5 Reduced cost of borrowing, enhanced liquidity and retained earnings Established a Strong Foundation for Growth Initiatives in 2014 strengthened the company’s balance sheet and improved liquidity Repurchased plant ownership interest, now at 96% Reduced overall debt balances • Eliminated parent company debt • Significantly reduced plant debt Strong balance sheet provides platform to grow the business through plant improvement projects and M&A

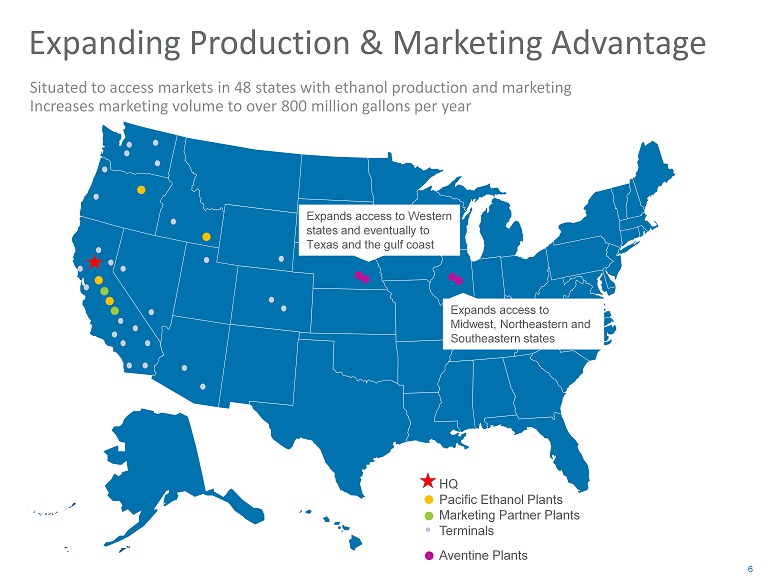

6 6 Expanding Production & Marketing Advantage HQ Pacific Ethanol Plants Marketing Partner Plants Terminals Aventine Plants Situated to access markets in 48 states with ethanol production and marketing Increases marketing volume to over 800 million gallons per year Expands access to Western states and eventually to Texas and the gulf coast Expands access to Midwest, Northeastern and Southeastern states

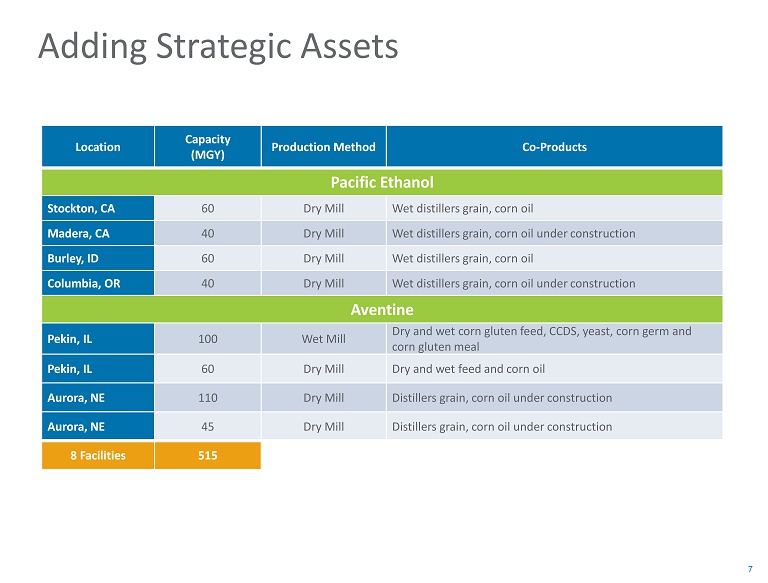

7 7 Adding Strategic Assets Location Capacity ( MGY) Production Method Co - Products Pacific Ethanol Stockton, CA 60 Dry Mill Wet distillers grain, corn oil Madera, CA 40 Dry Mill Wet distillers grain, corn oil under construction Burley, ID 60 Dry Mill Wet distillers grain, corn oil Columbia, OR 40 Dry Mill Wet distillers grain, corn oil under construction Aventine Pekin, IL 100 Wet Mill Dry and wet corn gluten feed , CCDS, yeast , corn germ and corn gluten meal Pekin, IL 60 Dry Mill Dry and wet feed and corn oil Aurora, NE 110 Dry Mill Distillers grain , corn oil under construction Aurora, NE 45 Dry Mill Distillers grain , corn oil under construction 8 Facilities 515

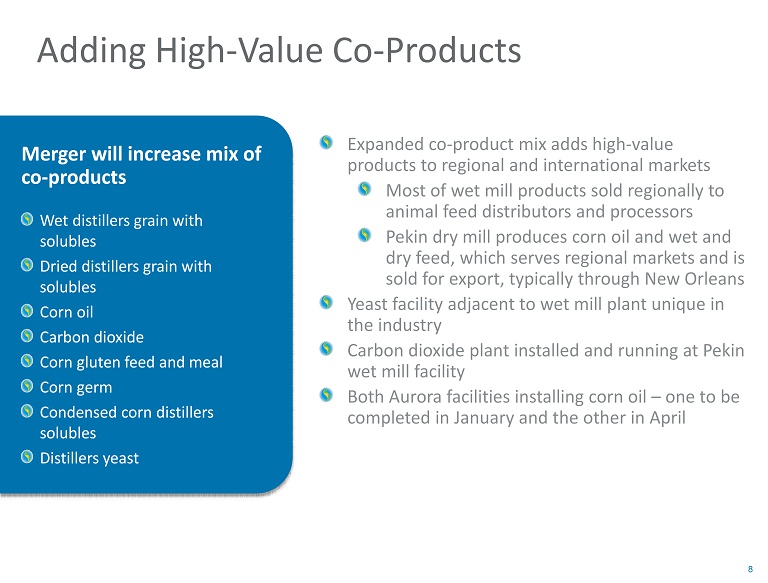

8 8 Adding High - Value Co - Products Merger will increase mix of co - products Wet distillers grain with solubles Dried distillers grain with solubles Corn oil Carbon dioxide Corn gluten feed and meal Corn germ Condensed corn distillers solubles Distillers yeast Expanded co - product mix adds high - value products to regional and international markets Most of wet mill products sold regionally to animal feed distributors and processors Pekin dry mill produces corn oil and wet and dry feed, which serves regional markets and is sold for export, typically through New Orleans Yeast facility adjacent to wet mill plant unique in the industry Carbon dioxide plant installed and running at Pekin wet mill facility Both Aurora facilities installing corn oil – one to be completed in January and the other in April

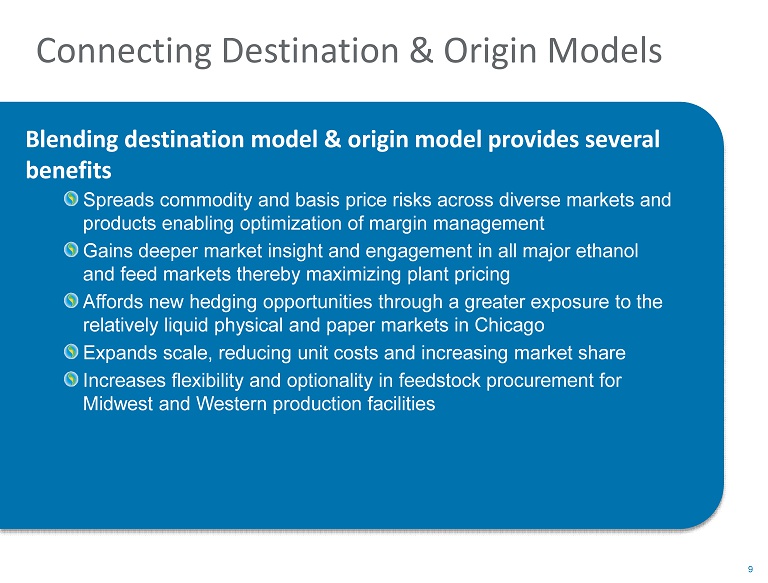

9 9 Connecting Destination & Origin Models Blending destination model & origin model provides several benefits Spreads commodity and basis price risks across diverse markets and products enabling optimization of margin management Gains deeper market insight and engagement in all major ethanol and feed markets thereby maximizing plant pricing Affords new hedging opportunities through a greater exposure to the relatively liquid physical and paper markets in Chicago Expands scale , reducing unit costs and increasing market share Increases flexibility and optionality in feedstock procurement for Midwest and Western production facilities

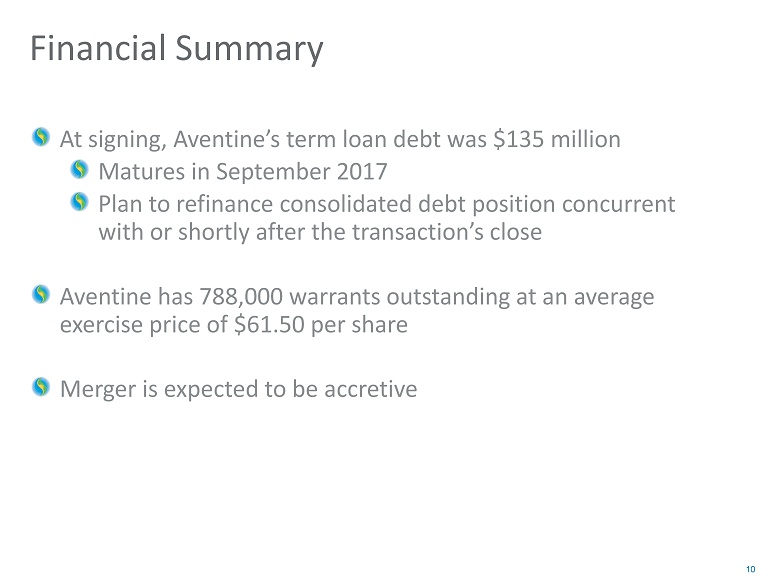

10 10 Financial Summary At signing, Aventine’s term loan debt was $135 million Matures in September 2017 Plan to refinance consolidated debt position concurrent with or shortly after the transaction’s close Aventine has 788,000 warrants outstanding at an average exercise price of $61.50 per share Merger is expected to be accretive

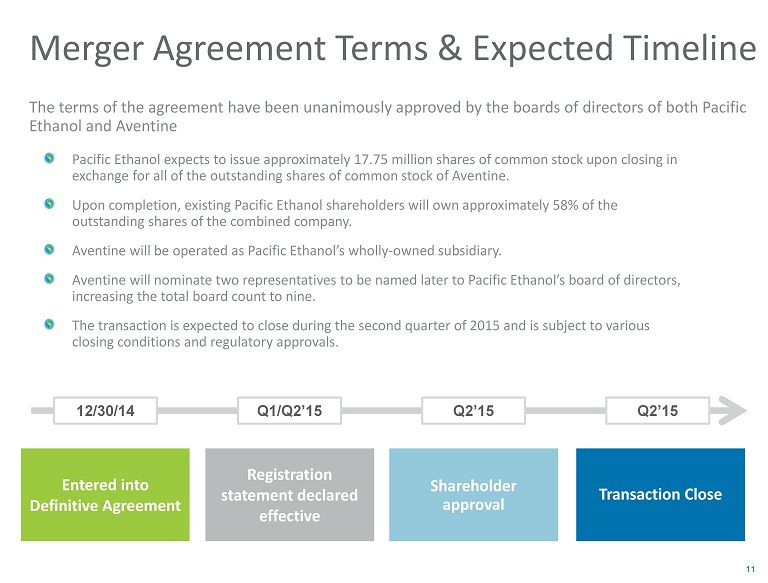

11 11 Pacific Ethanol expects to issue approximately 17.75 million shares of common stock upon closing in exchange for all of the outstanding shares of common stock of Aventine. Upon completion, existing Pacific Ethanol shareholders will own approximately 58% of the outstanding shares of the combined company. Aventine will be operated as Pacific Ethanol’s wholly - owned subsidiary. Aventine will nominate two representatives to be named later to Pacific Ethanol’s board of directors, increasing the total board count to nine. The transaction is expected to close during the second quarter of 2015 and is subject to various closing conditions and regulatory approvals. Merger Agreement Terms & Expected Timeline The terms of the agreement have been unanimously approved by the boards of directors of both Pacific Ethanol and Aventine Transaction Close Shareholder approval Registration statement declared effective Entered into Definitive Agreement 12/30/14 Q1/Q2’15 Q2’15 Q2’15

12 12 Transaction Summary Combines Production in Destination & Origin Markets, Providing Synergies in Production & Marketing Expands Pacific Ethanol’s Unique National Production & Marketing Advantages into New Markets Increases Annual Production Capacity to 515 Million Gallons and Marketing Volume to over 800 Million Gallons